Why international stocks are still a prudent strategy

We often write about the benefits of diversification within a portfolio. Diversification entails building portfolios with multiple asset classes; asset classes that don’t all correlate with each other. Sometimes, one asset class, such as fixed income, will lose value while another asset class gains value.

Constructing portfolios with 20- or 30-year (or longer!) time horizons means owning asset classes that may be out of favor for a while. One such example: international stocks. Toward that point, a recent blog by Michael Kitces on Kitces.com1 explains why this asset class shouldn’t be avoided.

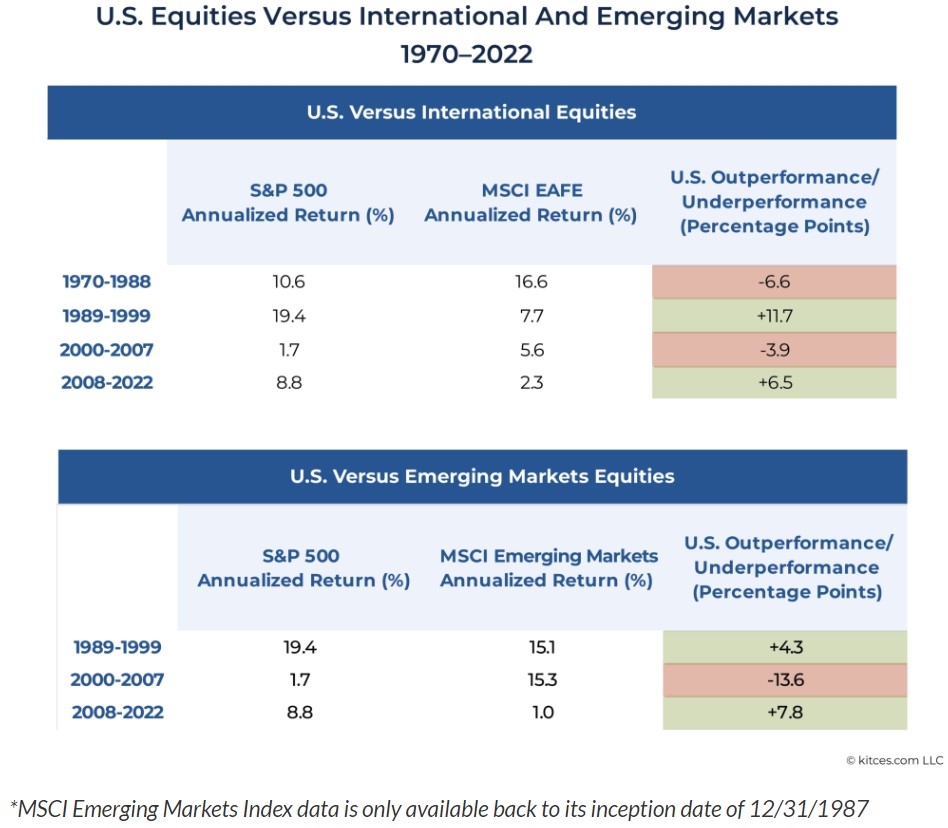

The argument for owning only domestic assets is that U.S. markets have outperformed international and emerging markets since 2008. From a behavioral perspective, investors may assume U.S. markets will continue to excel in the future because they have excelled in the recent past. This is known as recency bias, which causes investors to “confuse the familiar with the safe.” Of course, as we all know, “past performance does not promise future returns.”

A chart showing U.S. equities vs international and emerging markets can prove helpful in making the point that shunning non-U.S. markets can be detrimental to portfolio returns. (Portfolio volatility is a related issue but is a discussion for another day.)

“While these cycles of out- and underperformance are predictable at a high level, there are no crystal balls allowing us to foresee exactly when each shift will occur. The logical conclusion, then, is that investors should be diversified internationally – i.e., holding a mix of both US and international asset classes rather than betting on one to outperform the other – in order to capture the swings in valuation whenever they occur. In reality, however, many investors instead tend to simply buy what has performed best in the most recent period (at higher valuations and thus lower expected returns) and sell what has underperformed (at lower valuations and thus higher expected returns) – the exact opposite of the Investing 101 motto of ‘buy low, sell high.’ For investors, weighing recent results over historical evidence would have resulted in overweighting international stocks in 1990, US stocks in 2000, international stocks again in 2008 (all at the wrong time, when each asset class was about to enter a period of underperformance)…and once again, US stocks today.”

Further, “Beyond the faulty logic of buying after outperformance and selling after underperformance, investing only in a single country or region goes against the basic economic principle that diversification is the only ‘free lunch’ in investing – in other words, that a globally diversified portfolio can be expected to produce better risk-adjusted returns than any one country.”

Regarding market capitalization, U.S. equity markets comprise more than half of the value of world stock markets, so domestic stocks will almost always comprise the majority of a portfolio’s equity investments. But no single country, including the U.S., should comprise all of a portfolio’s equity exposure.

Yet, that’s exactly what so-called ‘home’ bias does to many investors; it leads them to put all their eggs into the U.S. stock basket. Unfortunately, investing in what you know, whether it’s the country where you reside or the company where you work, tends to add risk to portfolios, and increased risk is not the friend of long-term investors.

1 Swedroe, Larry. “International Diversification Is Still the Prudent Strategy.” Nerd’s Eye View | Kitces.Com, 17 Aug. 2023, www.kitces.com/blog/international-diversification-equities-economic-theory-risk-management/.