Why homeowners insurance deserves a spot in your summer plans

Summer’s here! Time for sunshine, cookouts, and pretending your lawn doesn’t need mowing every three days. But amid the fun, there’s one thing that often gets left out of the summer checklist: homeowners insurance.

Not exactly beach reading, we know (be on the lookout for our annual summer reading list – it’s coming soon!) - but when summer fun turns into summer mishaps, your insurance policy can save the day.

Summer can be Risky Business

Does anyone remember the 1983 movie Risky Business, starring Tom Cruise? Cruise’s character, Joel, is left alone by his parents while they take a summer vacation. Sparing you a plot summary, the movie spirals out of control, leaving the home in shambles and the parents wishing they had better coverage for all the damage done.

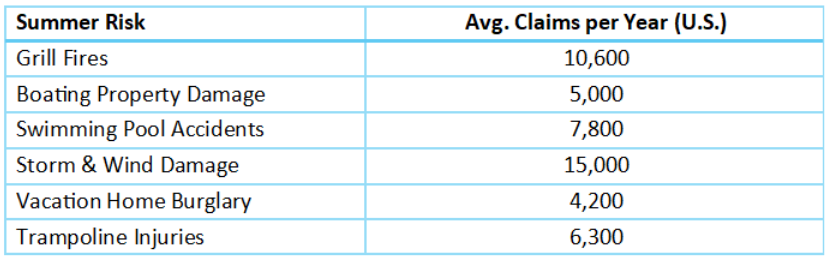

We’re sure none of you have little Joels to worry about. However, summer accidents can manifest in various forms. Here's a quick look1 at some of the most common summer-related claims:

It may be worth examining how your policy addresses some of these scenarios:

Managing a boat: What happens when your vessel takes out your dock—or worse, your neighbor’s? Your homeowners insurance might cover some boat-related damage at home, but usually with strict limits. For regular boating, you’ll want a dedicated policy.

Have a summer home?: If you have a vacation home, don’t assume your main home’s insurance has it covered. Seasonal properties are more prone to theft and storm damage, especially when vacant. Most carriers require a separate policy or endorsement for second homes. Before you head back to your full-time home, make sure your vacation property is properly protected.

Backyard fun: Pools, trampolines, and the annual “dad tries a flip off the diving board” event all increase liability risks. If someone gets hurt on your property, you could be on the hook. Your standard policy includes liability coverage, but now’s a great time to review your limits. An umbrella policy may offer extra peace of mind (and cushion your wallet).

Storm season approaches: From surprise downpours to falling tree branches, summer weather can do serious damage. The good news? Most standard homeowners policies cover wind and storm damage. Just be sure your coverage limits are enough to fully rebuild or replace.

Some suggestions to consider to stay safe and covered:

Inspect your home before summer – clear gutters, trim trees, check your roof.

Secure your home with cameras, lights, or a monitored alarm.

Review your policy with a trusted advisor (that’s your cue to call us – we work with property and casualty agents who can review existing policies and provide input).

Raise liability limits if you host guests or have high-risk features, such as a pool or trampoline.

Before summer gets into full swing, give your homeowners insurance a quick tune-up. It might not be as exciting as a new grill, but you’ll be happy you did so if an accident steers your way.

! Insurance Information Institute. Facts + Statistics: Homeowners Insurance. III, 2023, https://www.iii.org.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by S.F. Ehrlich Associates, Inc. (“SFEA”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from SFEA. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SFEA is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of SFEA’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a SFEA client, please remember to contact SFEA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, or revising our previous recommendations and/or services.