Fun With Charts!

When is the right time to invest?

When it comes to investing, who among us doesn’t like a winner? If you’re old enough to remember when the Fidelity Magellan Fund was the talk of the town, then you might remember its manager, Peter Lynch, talking about ten-baggers. Ten-baggers were stocks Lynch bought that appreciated in value 10 times. Rightly so, Lynch was proud of his ten-baggers.

While most of us may not have Lynch’s stock-picking abilities to find ten-baggers, there’s still the goal to buy low and sell high. Thus, when stock markets reach new highs, it’s understandable if we have a little reluctance to invest. After all, why not wait until the market drops before committing new funds?

Well, there’s a chart for that, and our friends at JP Morgan produced a chart1 showing investment returns if you were to invest at an all-time high as opposed to investing on any day. (If you’re interested, see the small print below the chart for the definitions for ‘invest at a new high’ and ‘invest on any day.’)

Based upon the data, investing at an all-time high doesn’t necessarily mean lower returns. Rather, it often means greater returns over time as market highs often lead to even more market highs.

Why a financial plan is so crucial to retirement success

Retiring successfully means living the type of life you planned to live once your working career comes to an end. For many, that means a life comparable to their pre-retirement life. For others, it might mean more charitable work or spending more money on travel.

Obviously, a solid financial plan takes future spending into consideration and also projects how spending may be impacted due to health and other considerations. Absent a financial plan, you’re left with a lot of conjecture, speculation, and, unfortunately, hope.

It may be hard to believe, but a retirement plan can literally go off the rails in Year 1 if the retiree spends more than was planned. And yes, there’s a chart that can help to clarify that comment.

In the 1990s, Bill Bengen, a fellow NAPFA member (a professional fee-only financial planner organization we belong to), proposed the 4% rule. Bill calculated that if retirees withdrew no more than 4% of their portfolio in Year 1, and adjusted withdrawals annually for inflation thereafter, they would have a very high probability of not outliving their money. Bill’s working hypothesis has withstood he test of time over the past 30 years.

While a 4% rate of withdrawal may not apply to everyone due to a variety of circumstances (e.g., age at retirement; portfolio size at retirement; investment returns during retirement; lifespan; other income; to name a few), it’s clear that higher withdrawals from a portfolio can add uncertainty to retirement planning.

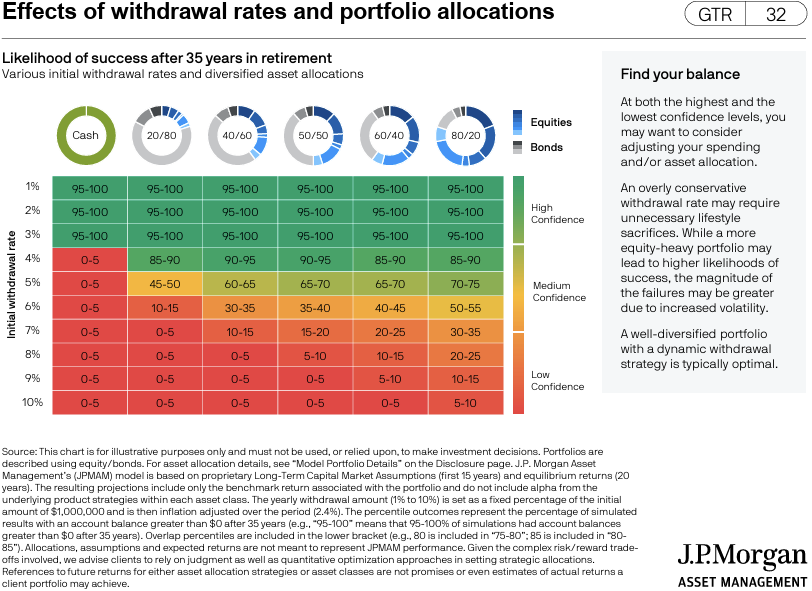

The chart2 shows the effects of higher withdrawal rates as linked to portfolio composition. A more conservative portfolio, for example, means lower returns over time, and a higher risk of outliving your money if annual withdrawals are too high. In contrast, lower withdrawal rates with a more balanced portfolio results in a much higher probability of success.

In the chart, high initial rates of withdrawal almost always lead to a lower confidence of success in a financial plan, regardless of the stock/bond ratio in a portfolio. What the chart also reveals, however, is that even the most conservative portfolios (i.e. 100% cash) start to fail with an initial 4% rate of withdrawal. It’s evident that portfolios that combine both stocks and bonds, along with a modest initial rate of withdrawal, have very high probabilities of success.

Withdrawal rates are obviously critical to a successful retirement plan. In essence, when funds are withdrawn, and the source of new funds has been eliminated (i.e., because you’re no longer employed), the retirement ‘pot’ can’t be refilled. When withdrawal rates are too high, that problem is exacerbated year after year after year.

When it comes to withdrawing funds from a pot of money, start slowly; that offers the best opportunity to be successful. Spend too much, and there are few opportunities to recover.

1 “Investing at all-time highs,” Slide 62, Guide to the Markets, J.P. Morgan. March 31, 2025.

2 “Effects of withdrawals rates and portfolio allocations,” Slide 32, Guide to Retirement, J.P. Morgan. March 31, 2025.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by S.F. Ehrlich Associates, Inc. (“SFEA”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from SFEA. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SFEA is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of SFEA’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a SFEA client, please remember to contact SFEA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, or revising our previous recommendations and/or services.