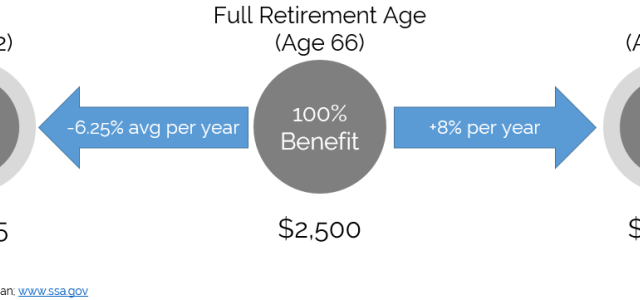

Social Security is a topic we frequently discuss with clients. The two main points of discussion include at what age to begin collecting Social Security

Read More

There's a lot of information out there about Social Security - let's separate the fact from fiction.

Read More

February 15, 2020

By: John Zeltmann

Recently I received a very helpful email from Social Security, filled with tips on how to avoid scams related to my Social

If you were born after 1929, have 40 credits of earnings history (e.g. 10 years’ of work), and are at least 62 years of age, you are eligible to collect Social

Read More

Put away your calculators and W2 earnings statements. This is not a math lesson - thank goodness - because the math behind the calculation of your Social

Read More

While a Social Security recipient can collect her retirement benefit any time between 62 and 70, that doesn’t mean she has completely unfettered access with no

Read More

You know you're entitled to a retirement benefit from Social Security, but there seem to be a lot of rules regarding when you can actually collect it. To

Read More

We've all been there before, a perfectly pleasant and enjoyable evening at a cocktail party is progressing swimmingly. The kids are tucked in, the dishes are

Read More

I was speaking with everyone's favorite skeptic, Billy Know-It-All, recently (you know, the one who claims that Social Security is bankrupt?), and he was up to

Read More

You took the money and ran, didn't you? When it comes to Social Security, most Americans do the same thing.

Read More

"I just turned 62 and am now eligible to collect my Social Security retirement benefit. Why wouldn't I take the money and run?"

Read More

The Social Security system is filled with complexity - questions ranging from when should I claim to isn't the Social Security system bankrupt to when can I

Read More