Stan's World - The Proof is in the Pudding

To some degree, the stock market almost always experiences volatility. While there have been periods that have been calmer than others, there’s usually some economic, political, or world event that influences its performance.

Extreme volatility (i.e., a large drop in the stock market) can lead to investor anxiety. Prolonged periods of volatility may make investors wary and often lead to discussions regarding safety. Nobody wants to lose money; when markets fall, investors want to preserve what they have. After all, who among us doesn’t remember how high their portfolio was at its highest point? That’s the number we want to preserve (until, of course, it goes even higher).

Occasionally, a client will read an article and raise the issue of annuities, especially if they read that they’re safer than the stock market. Or have guaranteed returns. The subject of annuities, however, is somewhat complex, so I’ll try to keep it simple while answering the real question: Should you consider one?

It’s probably a good bet that most fee-only financial advisors view annuities as a “four-letter word,” and not the good kind of four-letter word. While we’ve never ruled out the potential role an annuity might play in a portfolio, rarely have we ever told a client he/she should go out and buy one. (Full disclosure: we don’t sell annuities or any other insurance products.)

There are primarily two types of annuities: fixed and variable. As noted by their titles, a fixed annuity pays the account holder the same rate of return every year, while a variable annuity has a fluctuating account value, often based on the performance of the stock market. As these are insurance contracts, access to the funds you invest is limited, and sometimes the entire amount invested cannot be withdrawn. It’s not the type of product that you can just buy and sell.

The sales pitch for fixed annuities, as often presented by an interested salesperson, may start with: “You won’t lose money.” While not as attractive as “You had me at hello,” not losing money certainly has a certain cachet to it. But if you’re not going to lose money, what are you giving up? What’s the catch?

At their core, annuities function as investor insurance, designed to protect against the emotional and financial pain that can accompany market downturns.

While fixed annuities may offer a fixed rate of return for the life of the policy (or the annuitant's life), they generally do not adjust in response to inflationary pressures. The amount you receive each year remains the same.

Historically, annuities have been guilty of hefty fees (some we’ve reviewed range from 2% or more), and limited upside (via a performance cap). While the term ‘hefty fees’ doesn’t require further explanation, limited upside means annual returns are often capped, even if it’s a variable annuity. (The value of a variable annuity depends upon the underlying investments in its portfolio.)

For argument's sake, let’s assume the annuity includes a cap of 6%. If the underlying assets in the annuity are invested in the S&P 500 Index, for example, and that index goes up 12% in a year, a 6% cap means the annuity holder will see a return of 6%. The insurance company retains the excess gain…for themselves. On the other hand, when markets fall, the annuity will lose 0%, thus retaining its value from the preceding year. And therein lies the safety aspect; you don’t lose money. Lest we forget, however, markets go up more years than they go down (an average of 11% per year for the S&P 500 since 1990).

Some annuities are pitched as having no fee, but one must look under the hood to see that there may be some sleight of hand at work. After all, who is paying the salesperson? And what about the back office that underwrites the policies? Even if a fee is not readily apparent, it’s tucked in there somewhere. For example, a management fee may be deducted from the underlying investments. Alternatively, it may be classified as an administrative expense rather than a fee.

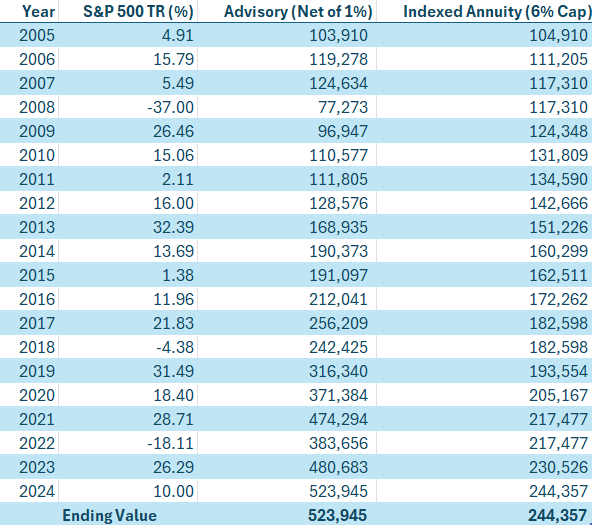

The “proof is in the pudding” is an old proverb that essentially means the ultimate test lies in the results. Whether or not someone should put their hard-earned money into an annuity is partially, if not mostly, dictated by where they can achieve the best results. For purposes of this discussion, John ran a model comparing a $100,000 portfolio managed by an investment advisor (with fees deducted) vs an annuity with a 6% cap. (The assumption is 100% of all funds are invested in the S&P 500 Index.) Pay attention to the ending value for both columns.

*Calculations available upon request. Please refer to important disclosure language below.

While protection against loss certainly sounds appealing, the inability to profit from outsize gains above a certain cap can be deflating. Using this hypothetical example, anyone who purchased the annuity 20 years ago with a 6% cap, had a little over 46% of the amount they would have had by investing in the S&P 500 Index outside of the annuity. That’s a high price for peace of mind. (Taxes are not considered in this hypothetical, and neither are any ancillary fees charged by the annuity company; the ending values for the annuity are gross numbers.)

If you’re willing to forego upside to gain protection on the downside, then an annuity becomes a consideration. For those willing to deal with market risk and volatility, join me in the “proof is in the pudding” crowd.

*Calculations available upon request

S.F. Ehrlich Associates, Inc. (“SFE”) is a registered investment advisory firm in New Jersey that offers investment advisory, financial planning, and consulting services to its clients, who generally include individuals, high net worth individuals, and their affiliated trusts and estates. Additional disclosures, including a description of our services, fees, and other helpful information, can be found in our Form ADV Part 2, which is available upon request or on the SEC's website at www.adviserinfo.sec.gov/firm/summary/121356.

If you are an existing client of SFE, it is your responsibility to immediately notify us if there is a change in your financial situation or investment objectives for the purpose of reviewing, evaluating or revising any of our previous recommendations and/or services.

This newsletter is for informational purposes only and is not intended to be and does not constitute specific financial, investment, tax, or legal advice. It does not consider the particular financial circumstances of any specific investor and should not be construed as a solicitation or offer to buy or sell any investment or related financial products. We urge you to consult with a qualified advisor before making financial, investment, tax, or legal decisions.

Information contained herein has been obtained from sources believed to be reliable. While we have no reason to doubt its accuracy, we make no representations or guarantees as to its accuracy. The opinions and analyses expressed herein constitute judgments as of the date of this newsletter and are subject to change at any time without notice. Any decisions you make based upon any information contained in this newsletter or otherwise are your sole responsibility.

No graph, chart, formula, or other device can, in and of itself, be used to determine which securities to buy or sell, or when to buy or sell such securities, or can assist persons in making those decisions.

Any securities mentioned in this newsletter are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell. There is no guarantee that a particular client's account will hold any or all of the securities mentioned in this newsletter. Additionally, from time to time, SFE’s officers, directors, employees, agents, affiliates, or client accounts may hold positions or other interests in the securities mentioned in this newsletter.

Any historical index performance provided herein is for illustrative purposes and includes the reinvestment of dividends and income, but does not reflect advisory fees, brokerage commissions, and other expenses associated with managing an actual client account. An index is an unmanaged group of stocks considered to be representative of different segments of the stock market in general. Index performance does not represent actual account performance. One cannot invest directly in an index. A description of each index mentioned in this newsletter is available upon request.

Any hypothetical performance shown or discussed herein is for illustrative purposes only. Hypothetical performance results have inherent limitations, including: they are generally prepared with the benefit of hindsight; do not involve financial risk or reflect actual trading; and do not reflect the economic and market factors, such as concentration, lack of liquidity or market disruptions, trading costs, and other conditions, that might have impacted our decision-making when managing actual client accounts. Since trades have not actually been executed, hypothetical performance results may have under- or overcompensated for the impact, if any, of certain market factors.

It should not be assumed that future performance of any specific investment, investment strategy, or index (including any discussed in this presentation) will be successful or profitable or protect against loss.

Any forward-looking statements or projections herein are based on assumptions. By their nature, forward-looking statements involve a number of risks, uncertainties, and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. You should not place undue reliance on forward-looking statements, which reflect our judgment only as of the date this newsletter was published.