Laid Off - In Charts

Over the years, many clients have shared the challenges they’ve faced after being laid off later in life. One by one, they came to realize that it’s a lot tougher to land a job in their 50s than it was when they were younger.

The Wall Street Journal1 recently reported on data collected by the Center for Retirement Research at Boston College, and the numbers on getting laid off later in life are sobering. “People in their 50s and 60s take longer to find new jobs, while others retire earlier than planned.”

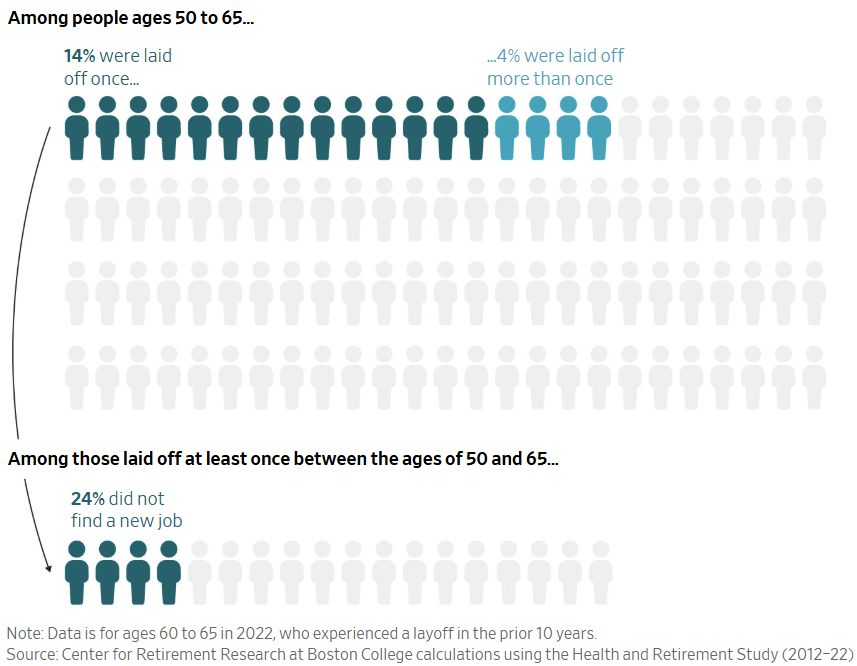

Five charts tell a compelling story for anyone who is laid off later in their career, which, unfortunately, is not uncommon. Among people aged 50 to 65, 14% had been laid off once, while 4% had been laid off more than once. Among those laid off at least once, 24% were unable to find a new job.

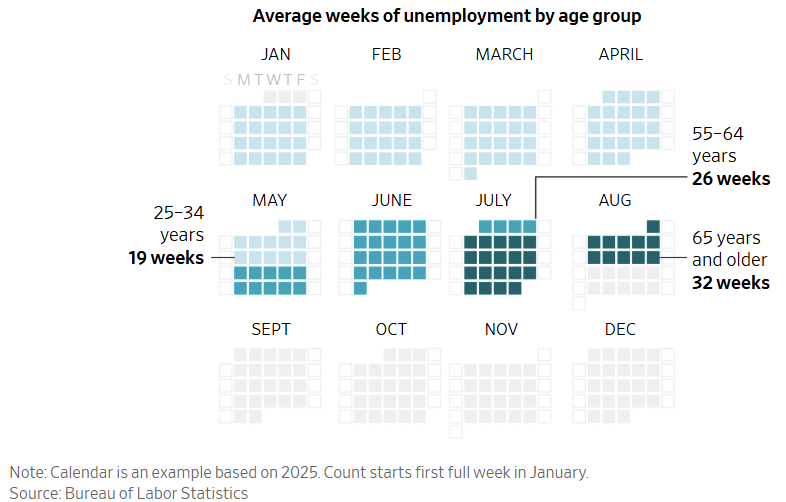

“The average weeks of unemployment for persons 55-64 who were laid off was 26 weeks, and 32 weeks for those 65 and older. “Older career workers who find new jobs take an 11% wage cut, on average…The pay cut was 15% for men and 7% for women.”

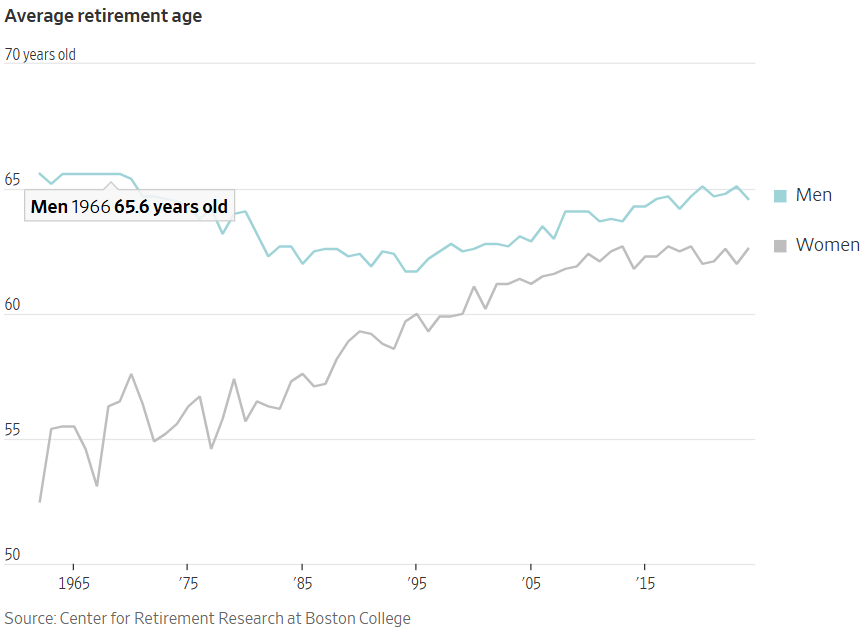

Since 1991, the average retirement age has increased by about three years, due to a substantial increase in the average retirement age for women.

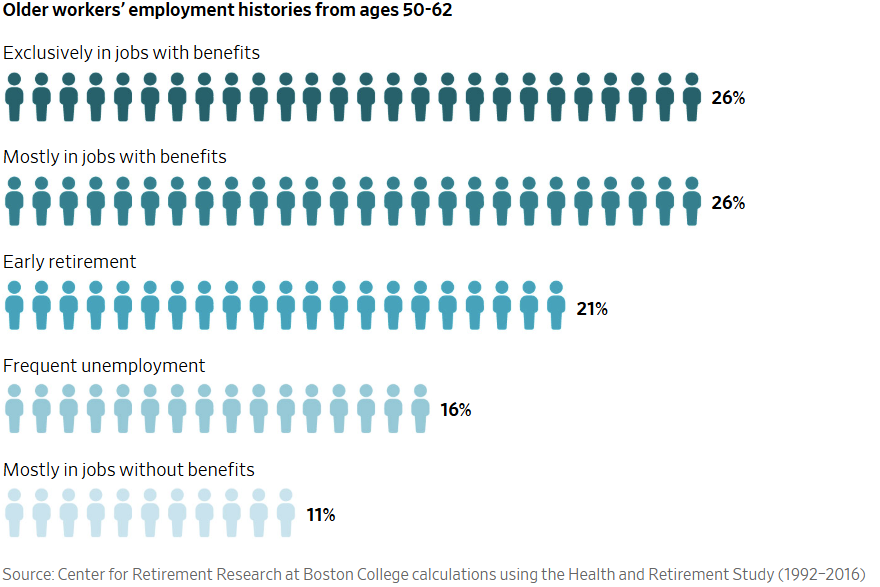

“Many Americans have a job at some point in their 50s and early 60s without 401(k) and health insurance benefits, according to Boston College’s Center for Retirement Research….The loss of benefits could be a sign of declining job quality for older job switchers….Those who frequently work without benefits in their 50s and 60s end up with about 25% less retirement income than workers with such benefits.”

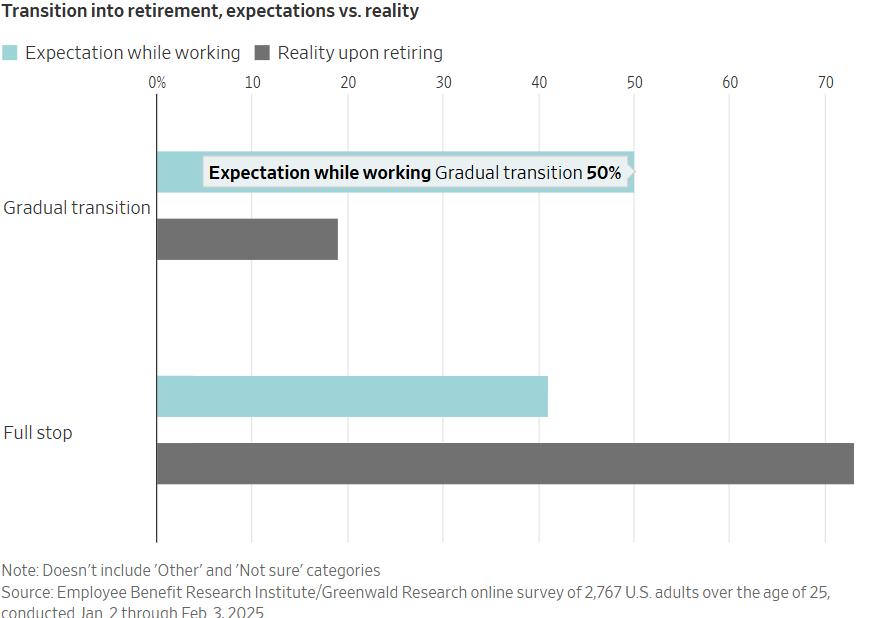

“Workers need to understand that the retirement decision will not always be their choice.” Workers believe, for example, they’ll be able to slowly transition into retirement, but the reality shows otherwise.

1 “Tergesen, Anne, and Veronica Dagher. “Here’s What a Late-Career Layoff Looks Like in America, in 5 Charts.” The Wall Street Journal, 19 July 2025.

S.F. Ehrlich Associates, Inc. (“SFE”) is a registered investment advisory firm in New Jersey that offers investment advisory, financial planning, and consulting services to its clients, who generally include individuals, high net worth individuals, and their affiliated trusts and estates. Additional disclosures, including a description of our services, fees, and other helpful information, can be found in our Form ADV Part 2, which is available upon request or on the SEC's website at www.adviserinfo.sec.gov/firm/summary/121356.

If you are an existing client of SFE, it is your responsibility to immediately notify us if there is a change in your financial situation or investment objectives for the purpose of reviewing, evaluating or revising any of our previous recommendations and/or services.

This newsletter is for informational purposes only and is not intended to be and does not constitute specific financial, investment, tax, or legal advice. It does not consider the particular financial circumstances of any specific investor and should not be construed as a solicitation or offer to buy or sell any investment or related financial products. We urge you to consult with a qualified advisor before making financial, investment, tax, or legal decisions.

Information contained herein has been obtained from sources believed to be reliable. While we have no reason to doubt its accuracy, we make no representations or guarantees as to its accuracy. The opinions and analyses expressed herein constitute judgments as of the date of this newsletter and are subject to change at any time without notice. Any decisions you make based upon any information contained in this newsletter or otherwise are your sole responsibility.

No graph, chart, formula, or other device can, in and of itself, be used to determine which securities to buy or sell, or when to buy or sell such securities, or can assist persons in making those decisions.

Any securities mentioned in this newsletter are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell. There is no guarantee that a particular client's account will hold any or all of the securities mentioned in this newsletter. Additionally, from time to time, SFE’s officers, directors, employees, agents, affiliates, or client accounts may hold positions or other interests in the securities mentioned in this newsletter.

Any historical index performance provided herein is for illustrative purposes and includes the reinvestment of dividends and income, but does not reflect advisory fees, brokerage commissions, and other expenses associated with managing an actual client account. An index is an unmanaged group of stocks considered to be representative of different segments of the stock market in general. Index performance does not represent actual account performance. One cannot invest directly in an index. A description of each index mentioned in this newsletter is available upon request.

Any hypothetical performance shown or discussed herein is for illustrative purposes only. Hypothetical performance results have inherent limitations, including: they are generally prepared with the benefit of hindsight; do not involve financial risk or reflect actual trading; and do not reflect the economic and market factors, such as concentration, lack of liquidity or market disruptions, trading costs, and other conditions, that might have impacted our decision-making when managing actual client accounts. Since trades have not actually been executed, hypothetical performance results may have under- or overcompensated for the impact, if any, of certain market factors.

It should not be assumed that future performance of any specific investment, investment strategy, or index (including any discussed in this presentation) will be successful or profitable or protect against loss.

Any forward-looking statements or projections herein are based on assumptions. By their nature, forward-looking statements involve a number of risks, uncertainties, and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. You should not place undue reliance on forward-looking statements, which reflect our judgment only as of the date this newsletter was published.