Scammers are Scamming: Be Afraid

Raise your hand if you remember the “Is it live, or is it Memorex?” commercial? Change a few words, and that’s how you should consider emails you receive that ask you to enter personal information: Is it real, or is it a scam?

Of the countless emails we receive, scam and otherwise, we have selected two to illustrate what we examine when assessing the validity of an email and how to verify its authenticity. Although we’re not experts, it’s essential to follow at least a few simple steps before acting on any emails you may receive.

Dashlane

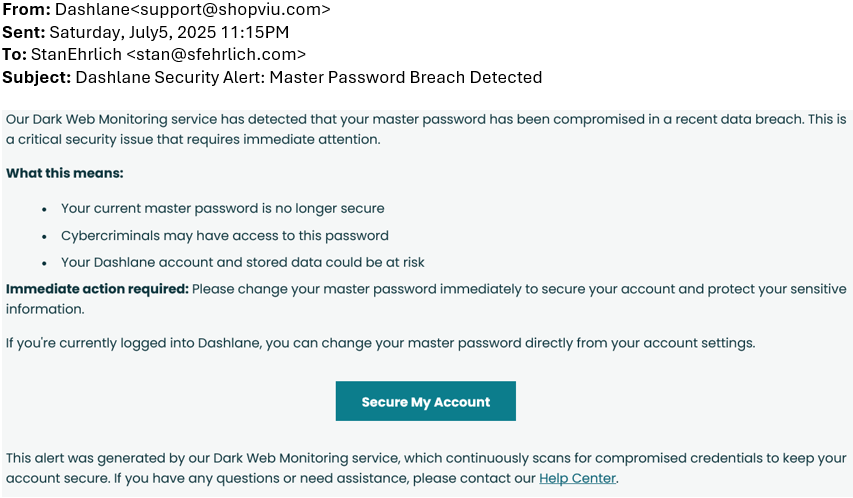

Below, please find an email we received from Dashlane, which is a password manager that allows you to maintain all your passwords in a single, secure location. As we’re both fans and users, imagine our concern when we received the alert below:

Read the email. Do you see anything suspicious?

Let’s start with the email address of the sender, the first place you should look when you receive any official-looking email. Looking at the “From” address, was the email sent by someone at Dashlane.com?

In this instance, the return address shows “shopviu.com”. That alone should alert you that the email is a fraud, and the email should be deleted. If you’re still in doubt, Google “shopviu”; you’ll find it’s allegedly an eyewear company. This is an email from a scammer. Not only should it be deleted, but it’s even questionable whether you should buy your glasses from shopviu.com.

PNC Bank

Email #2 allegedly came from our friends at PNC Bank, or did it? It’s too long to include in our newsletter, but here are the key points:

After 30 years, PNC was reaching out to confirm pertinent information about our business, including EIN number, related Social Security number(s), and our online PIN. They were also asking us to confirm account numbers and mailing addresses.

We were to click the link in the email, which would take us to a website where we would enter the required information.

The email even included a consequence if we didn’t respond – potential account closure.

Our initial response was to declare fraud. After 30 years, PNC Bank picked that week to confirm our business information? Information they wanted us to re-enter on ‘their’ website? Really?

On the other hand, what if we really are required to complete a certain form lest PNC Bank puts a hold on our account? What if this is legitimate?

As we did with Dashlane, the first thing we did was check the sender’s email address, which did, in fact, include “@pnc.com”. That may feel compelling, but it’s not conclusive, because you can falsify a sender’s email address.

The email also includes a website we’re instructed to visit to complete this allegedly required form. The website included the letters “pnc.com” within the address, but, at least to us, its validity was still inconclusive.

A phone number is included in the email, which can be called for assistance. To confirm the authenticity of that number, we went to the official PNC website. When the phone number in the email did not appear on the website, our level of suspicion rose even further. (NOTE: Never click on a website link included in a suspicious email, and never call a phone number included in the body of the email. Instead, Google the company name and go directly to its official website.)

Finally, we called a PNC phone number listed on the official PNC website, where we eventually spoke to a representative in the business banking department. Lo and behold, this email was legitimate, and a PNC representative verified the phone number included in the email. She also said they’ve received quite a few phone calls from their business customers. Like us, those customers were all correct to call to seek verification from a trusted number. Kudos to them, and to us.

Did this process take a few minutes? Absolutely, but it’s the only way to be sure you’re responding to a legitimate website if/when you’re requested to enter personal, or, as in our case, business information.

When it comes to emails and unsolicited phone calls, we should all follow the advice used by good carpenters: measure twice and cut once. Think twice (or more) before providing personal information on a phone call or opening unsolicited links either in an email or a pop-up on your computer. (And don’t forget you can always call or email us with any questions.) The potential cost of making a mistake can be far worse than the extra few minutes it takes to confirm the integrity of the sender (or caller).

S.F. Ehrlich Associates, Inc. (“SFE”) is a registered investment advisory firm in New Jersey that offers investment advisory, financial planning, and consulting services to its clients, who generally include individuals, high net worth individuals, and their affiliated trusts and estates. Additional disclosures, including a description of our services, fees, and other helpful information, can be found in our Form ADV Part 2, which is available upon request or on the SEC's website at www.adviserinfo.sec.gov/firm/summary/121356.

If you are an existing client of SFE, it is your responsibility to immediately notify us if there is a change in your financial situation or investment objectives for the purpose of reviewing, evaluating or revising any of our previous recommendations and/or services.

This newsletter is for informational purposes only and is not intended to be and does not constitute specific financial, investment, tax, or legal advice. It does not consider the particular financial circumstances of any specific investor and should not be construed as a solicitation or offer to buy or sell any investment or related financial products. We urge you to consult with a qualified advisor before making financial, investment, tax, or legal decisions.

Information contained herein has been obtained from sources believed to be reliable. While we have no reason to doubt its accuracy, we make no representations or guarantees as to its accuracy. The opinions and analyses expressed herein constitute judgments as of the date of this newsletter and are subject to change at any time without notice. Any decisions you make based upon any information contained in this newsletter or otherwise are your sole responsibility.

No graph, chart, formula, or other device can, in and of itself, be used to determine which securities to buy or sell, or when to buy or sell such securities, or can assist persons in making those decisions.

Any securities mentioned in this newsletter are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell. There is no guarantee that a particular client's account will hold any or all of the securities mentioned in this newsletter. Additionally, from time to time, SFE’s officers, directors, employees, agents, affiliates, or client accounts may hold positions or other interests in the securities mentioned in this newsletter.

Any historical index performance provided herein is for illustrative purposes and includes the reinvestment of dividends and income, but does not reflect advisory fees, brokerage commissions, and other expenses associated with managing an actual client account. An index is an unmanaged group of stocks considered to be representative of different segments of the stock market in general. Index performance does not represent actual account performance. One cannot invest directly in an index. A description of each index mentioned in this newsletter is available upon request.

Any hypothetical performance shown or discussed herein is for illustrative purposes only. Hypothetical performance results have inherent limitations, including: they are generally prepared with the benefit of hindsight; do not involve financial risk or reflect actual trading; and do not reflect the economic and market factors, such as concentration, lack of liquidity or market disruptions, trading costs, and other conditions, that might have impacted our decision-making when managing actual client accounts. Since trades have not actually been executed, hypothetical performance results may have under- or overcompensated for the impact, if any, of certain market factors.

It should not be assumed that future performance of any specific investment, investment strategy, or index (including any discussed in this presentation) will be successful or profitable or protect against loss.

Any forward-looking statements or projections herein are based on assumptions. By their nature, forward-looking statements involve a number of risks, uncertainties, and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. You should not place undue reliance on forward-looking statements, which reflect our judgment only as of the date this newsletter was published.