Spend less and live longer or spend more and die younger?

March 31, 2022

Michael Bloomberg is credited with saying: “…the best financial planning ends with bouncing the check to the undertaker.” The man was right when he first said it, and he’s still right today. Who would have ever thought that living too long could be a bad thing?

Imagine if you knew the year when you were going to die. Think of all the decisions you could make years ahead of that fateful year, knowing that almost every decision would have a high probability of being right. There would be no growing old and second-guessing what happened years ago. No looking back at a life filled with coulda, woulda, and shoulda. Every decision would be spot-on.

You would know when to quit your job, exactly how much to save, how much (and at what age) to travel, whether to sell your home, how much to gift to your children, or how much to donate to charities. In fact, you would have the ability to plan so well that your final expense would probably occur just before you passed, thus denying your undertaker of his/her money.

Alas, most of us will not get to live that fantasy. Instead, we’re left to ponder how long we might live and face the age-old question: Do I have enough money to live the rest of my days as I would like to live them?

You may have read that COVID killed so many Americans that national life expectancy dropped. While true, specific sub-sets of Americans suffered far more than others. Thus, we didn’t lower life expectancies in our financial plans. In fact, we may even extend some of them.

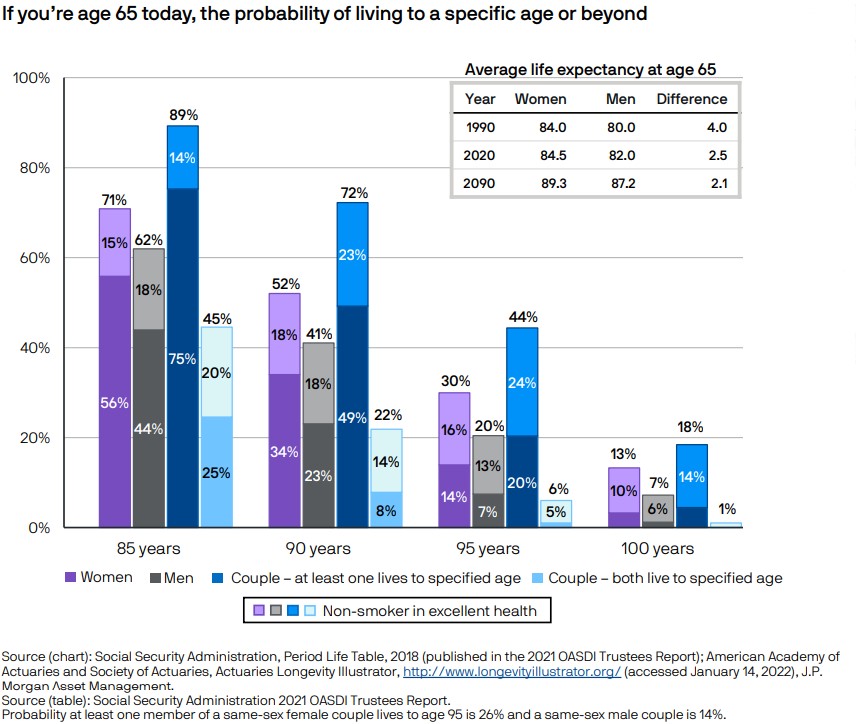

The chart below details the odds of a 65-year-old living into his/her 80s, 90s, and longer. If you’re a 65-year-old non-smoking couple, for example, there’s a 45% chance you’ll both live to age 85; a 22% chance you’ll both live to age 90; a 6% chance you’ll both live to age 95, and a 1% chance you’ll both live to age 100. Of even greater significance is that if a couple both live to age 65, there’s an 18% chance at least one of them will live to 100.

The numbers look even better for 70-year-olds. Per Business Insider1, “Almost 2/3 of 70-year-old men and almost ¾ of 70-year-old women will live at least another ten years, and 1/5 of men will make it to 90, as will 1/3 of women.”

As planners, a 22% probability that a 65-year-old couple will live to age 90 makes it reasonable to plan for two deaths near or in the early 90s but still not reasonable to assume both spouses will live to 95 or 100. Still, it’s data like this that can potentially extend the upper age limit for at least one spouse when financial plans are updated.

But when you extend longevity in a financial plan, how does that impact investment portfolios? Will that mean a greater percentage of portfolio assets will need to be invested into the stock market to allow for more growth? Does extending longevity result in adding risk to a portfolio?

Knowing more assets may be required to pay for extended longevity may cause some people to work longer prior to retirement. Others may take on part-time employment to add to cash flow. (Obviously, the more you earn prior to or in retirement, the less of a burden on savings.) Or, knowing they may live longer, might retirees be more conservative about spending during the early years of retirement?

A longer lifespan poses an interesting conundrum, and that’s why we have the conversations we have with clients when we prepare and update financial plans. To quote the great philosopher Stan Ehrlich: “The good news is we’re all living longer. And the bad news is we’re all living longer.”