Social Security: Bursting the bubble on a few myths

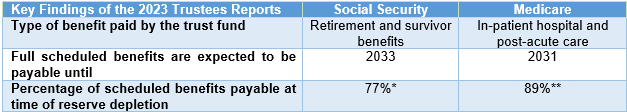

“Unless Congress acts to fix the program, Social Security will be unable to pay retirees full benefits starting in 2034, a year earlier than projected in 2022, according to the annual report of the Social Security Board of Trustees. …If the trust fund is depleted, Social Security will be able to pay retirees only about 77% of their scheduled benefits…Separately, Medicare’s Board of Trustees said Medicare’s hospital trust fund has sufficient funds to cover 100% of bills until 2031, which is three years later than last year’s projection.”

Source: Solheim, Mark. “Social Security Trust Fund Countdown.” Kiplinger’s Personal Finance, June 2023.

*The percentage of scheduled benefits payable is projected to decline to 71% by 2097.

**The percentage of scheduled benefits payable is projected to decline to 81% by 2047 before gradually increasing to 96% by 2097.

Here are five Social Security myths you may not realize are false1:

1. There are no taxes on Social Security benefits: “That hasn’t been true in nearly 40 years. Yet people still believe it...According to the Social Security Administration, about 40% of people who receive benefits must pay income tax. Income limits dictate who pays income tax on benefits and what portion of the benefits is taxable.”

2. Filing decisions are final: “(Claimants) can change their mind about filing and withdrawing within the first 12 months of collecting. This is allowed only once, and they must pay back what they collected…People who have reached their full retirement age but aren’t yet 70 can also suspend their benefits. They can earn delayed retirement credits for each month that benefits are suspended, leading to a higher benefit in the future.”

3. Every worker is eligible for Social Security benefits: “Particular railroad and government employees, including some teachers at public schools and universities, do not pay the taxes used to fund Social Security benefits and are not eligible for them.”

4. Social Security is only for people who are no longer working: “If clients collect Social Security before their full retirement age, the Social Security Administration may deduct their benefit by $1 for every $2 they earn over an income cap set annually (for 2023, it is $21,240). In the year that clients reach their full retirement age, the income cap is higher (it’s set at $56,520 in 2023), and $1 is deducted from their benefits for every $3 earned. Once clients reach full retirement age, there is no limit or penalty for earning income.”

5. When a spouse dies, the widowed spouse is eligible for both a survivor’s and their own benefit: “In short, there is no double dipping with Social Security.” If a spouse dies while he and his spouse are both collecting benefits from Social Security, the surviving spouse will collect the higher of the two benefits, but that’s all.

1 Dorosky, Alyson. “Five Social Security Myths That Might Be Steering Your Clients Wrong .” Financial Advisor Magazine, January/February 2023.