The secret to successfully investing in the stock market

May 15, 2021

For a hundred years or more, investors have been seeking the holy grail of investing: how not to lose money in the stock market. Finally, MONEY.com1 has revealed the answer, and it can be condensed into two words: Don’t sell!

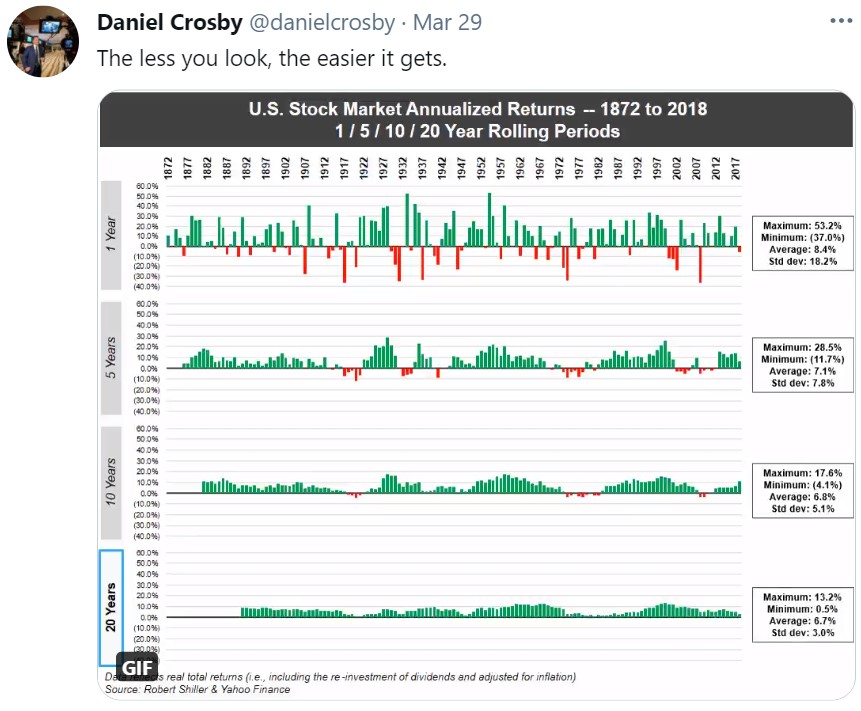

The chart below highlights how markets have performed over 1, 5, 10, & 20 year periods from 1872-2018.

The article points out, “The long-term advantage of stocks versus other assets, like bonds, is hardly a new concept.” But the reason why “so many well-intentioned investors continue to lose money in the stock market” is due to “a lack of patience.”

By examining stock market returns over longer intervals, one can more easily understand why it’s so important to STAY invested during market ups and downs. As graphically depicted above, periodic returns for the four periods shown are (from top to bottom):

- 1-year: From -37.0% to 53.2%

- 5-year: From -11.7% to 28.5%

- 10-year: From -4.1% to 17.6%

- 20-year: From 0.5% to 13.2%

While not every 10-year interval was positive, returns were positive 94% of the time.

If the odds favor long-term investors, why don’t investors stick to the ‘stay invested’ approach? Notes the author: “...the hardest thing for many investors to do is just that: give the market time to recover from one of its inevitable rough patches…Because even a rational person could make irrational decisions during a stressful time….”

There is a positive return in the stock market over time because there’s risk, and that risk comes with volatility (as in price swings). While emotions run high during market swings - exuberance when the market soars; fear when the market drops – it’s precisely those emotions that push investors off their game. Everyone wishes they were all-in when the markets are setting new highs, while the sentiment is exactly the opposite when the markets go into free-fall. It’s human nature, and we’re all susceptible to acting on our emotions.

What makes staying invested easier to handle? Rebalancing. Yes, rebalancing means winners will occasionally get sold, while losers will occasionally get bought. Most importantly, over time, staying invested while occasionally fine-tuning a portfolio really does work. The proof is in the numbers.