Market pullbacks and market downturns

September 30, 2021

When the Dow Jones Industrial Average was at more pedestrian numbers, like 6,000, 8,000, or even 10,000, market drops of 600, 700, and 800 points caused quite a stir. That reaction was logical, as a drop of 600 points when the Dow was at the 10,000 level meant a loss of 6%. A drop of 600 points when the Dow is at 30,000, however, represents a loss of 2%. Yes, it’s still a loss, but a drop of that size in today’s stock market means a substantially smaller loss to a diversified portfolio.

Regardless of whether you’re a long-term investor or a novice, a drop of 600 or 700 points can be striking when it appears on-air, online, or in a newspaper: Dow DOWN 600 points!

An obvious concern when the market records a significant drop – as measured by points, at least – is that it’s the beginning of a long-awaited correction. (NOTE: Every correction is long-awaited. We all know they’re coming; we just don’t know when.) But is the fear accurate; does a market pullback really mean more nefarious news is ahead?

Notes Vanguard1, “…2020 qualifies as one of the most tumultuous years in recent memory,” as the year included the first case of COVID in the US; the World Health Organization declaring a pandemic; protests opposing police brutality erupting across the country; a state of emergency in CA as wildfires spread across the State; an unprecedented presidential election; and the FDA approving the Pfizer vaccine. So how did the market do, considering it was down more than 30% on March 23, 2020? The S&P 500 ended the year UP 18.40%!

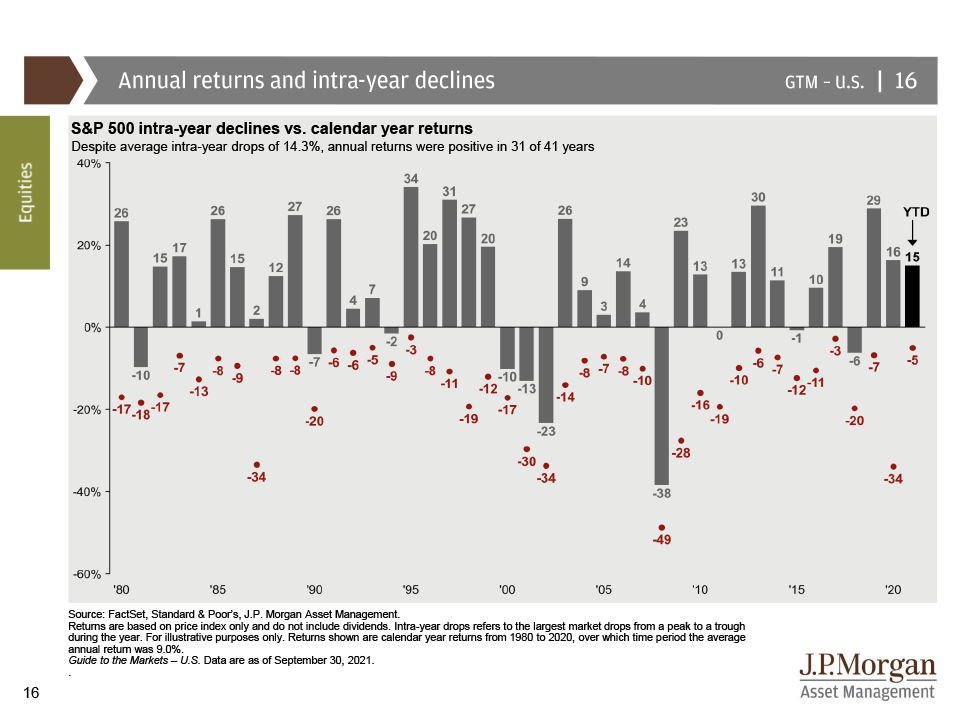

If we look at a longer time frame, Dimensional Funds states the following about the period 2001 – 2020: “Stock market declines over a few days or months may lead investors to anticipate a down year. But the US stock market had positive returns in 16 of the past 20 calendar years, despite some notable dips in many of those years.” (See chart below.) Of significance, note “Intra-year declines for the (S&P 500) index ranged from 3% to 49%.”

The next time the headlines talk about a sizable drop in the stock market, take a moment to consider the following data from Dimensional: “A broad market index tracking data since 1926 in the US shows that stocks have generally delivered strong returns over one-year, three-year, and five-year periods following steep declines. Just one year from a decline of 10% or 20%, returns were higher than the long-term average of 9.6%...Looking three and five years later also shows annualized returns averaged higher than the long-term average.”

While it may be challenging from an emotional perspective, research2 shows that buying when the market is falling can lead to outsized gains when measured over a long period of time. To quote the great investor, Warren Buffett: “…be fearful when others are greedy and greedy only when others are fearful.”