Market highs and inflation - The risk of assumption

February 15, 2022

If you’re of a certain age, you may recall the classic TV show, The Odd Couple. The show focused on two friends who became roommates, played by Tony Randall (Felix Unger) and Jack Klugman (Oscar Madison). In one especially memorable episode, Felix used a blackboard in court to disassemble the word assume: “When one assumes, you make an ass of ‘u’ and ‘me’.”

And so it goes with investments. Assume you know what will happen next in the stock market, and think of Felix standing in front of you, pointing at the blackboard. The only difference is you won’t be laughing.

Inflation: There is a widespread misperception that inflation always leads to poor stock market returns. A lot has been written on inflation over the past few months as inflationary numbers have hit multi-year highs. While we never know what the market will do next, history tells us that inflation alone is unlikely to shift the narrative. (There are notable exceptions, such as during the period of hyperinflation during the late 1970s and early 1980s.)

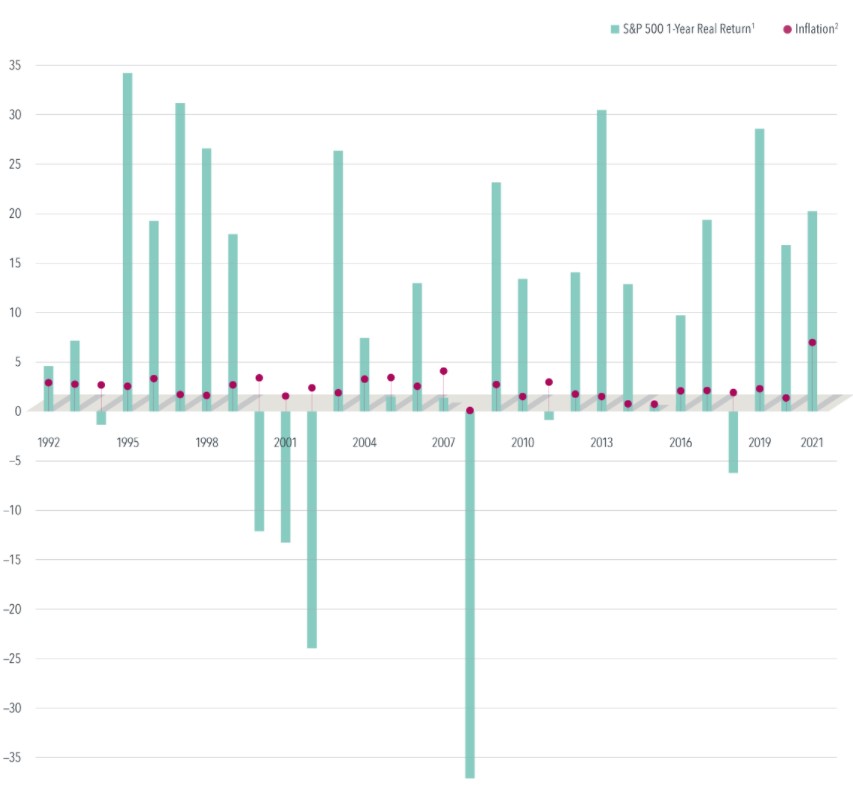

According to data published by Dimensional Funds1,2, “A look at equity performance in the past three decades does not show any reliable connection between periods of high (or low) inflation and U.S. stock returns.”

“Over the period charted, the S&P 500 posted an average annualized return of 8.1% after adjusting for inflation. Going all the way back to 1926, the annualized inflation-adjusted return on stocks was 7.3%.

“History shows that stocks tend to outpace inflation over the long term – a valuable reminder for investors concerned that today’s rising prices will make it harder to reach their financial goals.”

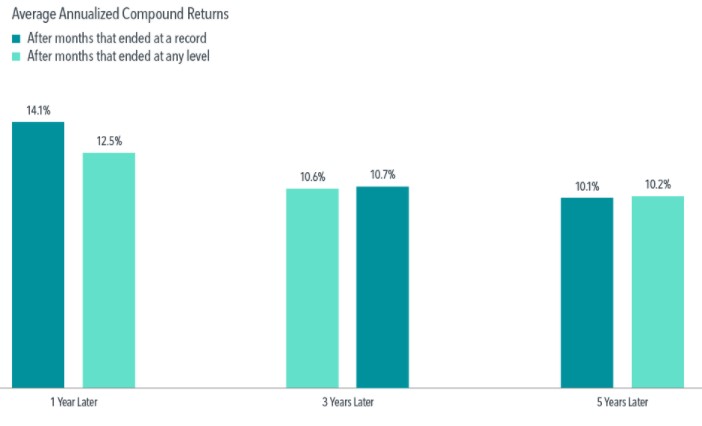

Market Highs: “Many investors may think a market high is a signal stocks are overvalued or have reached a ceiling. But they may be surprised to find out that the average returns for the S&P 500 Index one, three, and five years after a new market high are similar to the average returns for the index over any one-, three-, or five-year period.”

“In looking at all 1,000-plus monthly closing levels between 1926 and 2020 for the S&P 500 Index, 30% of the monthly observations were new market highs. After those highs, the average annualized compound returns ranged from nearly 14% one year later to just under 10% five years later. Those results were close to average returns over any given period of the same length. When viewed in terms of the index simply having risen or fallen, the S&P 500 was higher a year after notching a record 82% of the time, and 78% of the time after five years.”