Longevity and retirement - will you outlive your savings?

When you’re in the business of financial planning, certainty is rarely an outcome. If someone were to retire with $10 million in investable assets, for example, while spending $50,000 per year, we could say with (almost) absolute certainty that they will never outlive their money. The truth is, however, that most of us have fewer assets, spend more each year, or some combination of the two. Thus, for the rest of us, the outcome of our financial plans falls into a range of probabilities.

Aside from any variance in annual spending (which is often related to lifestyle and health), one of the most unpredictable unknowns is life span. How do you know how many years you have left to live?

There’s a reason why Social Security begins reduced payments at age 62; we used to have a sharply lower life expectancy than we do now. Many people used to work to the age of 62, retire, and then die within a few years. Often, waiting to collect Social Security was viewed as a bad option.

But times have changed. Due to better health care, a reduction in smoking, and improved personal care (including exercise), life expectancy is now far longer than it was when Social Security was signed into law by President Roosevelt on August 14, 1935.

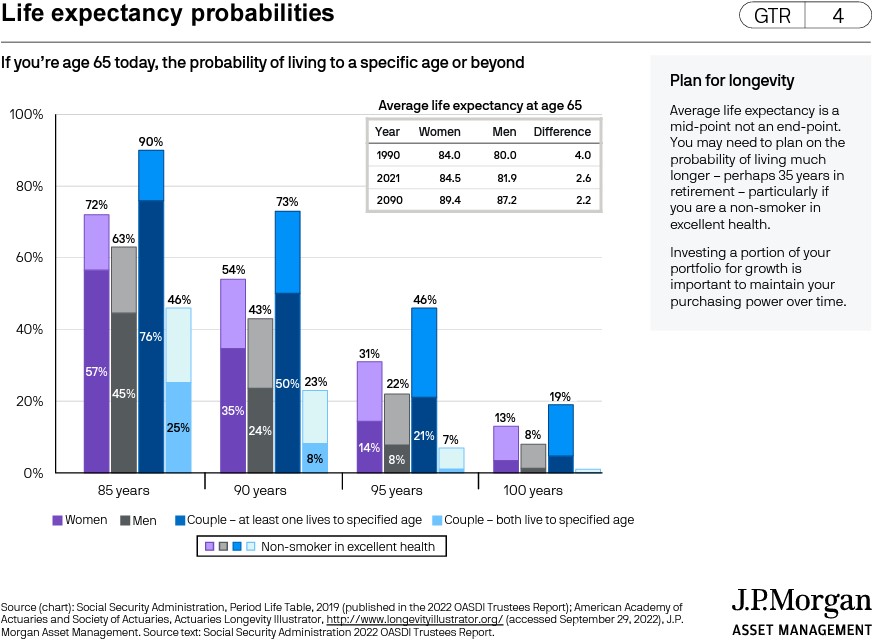

Using a chart prepared by JP Morgan (Life expectancy probabilities, see chart below), a glance at life expectancy probabilities can be both sobering and exhilarating in the same breath. (“Look at how many more years I may live!” or “Oh, no. This is all the money I have. Look at how many more years I may live!”)

Here are a few noteworthy highlights, all based on a person living to age 65:

- The life expectancy for a woman who lives to age 65 is 84.5; for a man, it’s 81.9.

- There is a 90% chance that at least one person in a couple will live to age 85; a 73% chance of at least one living to age 90; a 46% chance of one living to age 95; and a 19% chance (almost 1 in 5!) that one person within a couple will live to age 100.

- For a woman who lives to age 65, there is a 72% chance of living to age 85; 54% chance of living to age 90; 31% chance (almost 1 in 3!) chance of living to age 95; and a 13% chance of living to age 100.

- For a couple who both live to age 65, there is a 46% chance (almost 1 in 2!) they’ll both live to age 85 and even a 23% chance they’ll both live to age 90.

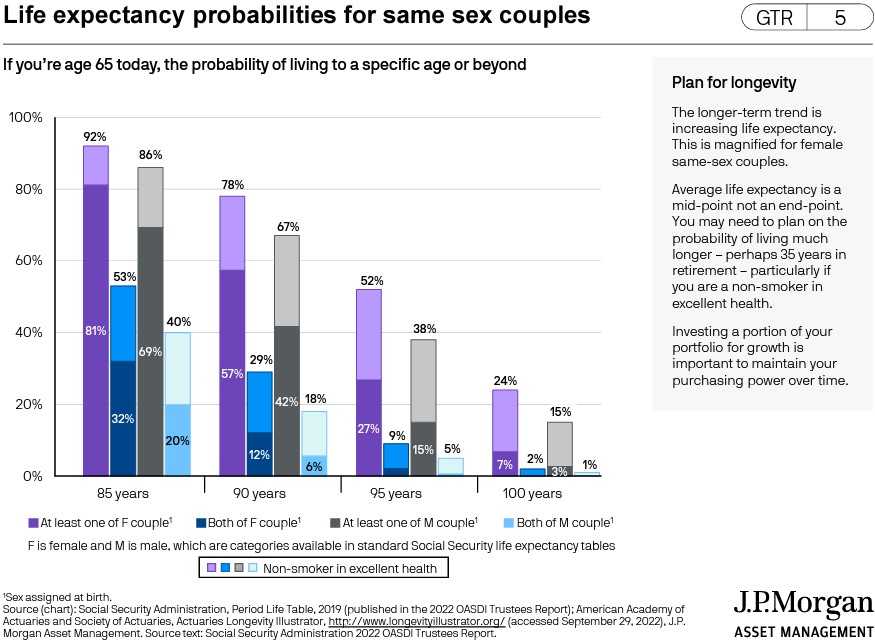

It’s easy to see that planning for retirement is not as simple as us asking “How much money do you have,” and “How much do you spend a year?” It’s far more nuanced and complex. In fact, it can get even more complicated for same-sex couples.

Starting with the assumption that both partners live to age 65:

- There is a 92% probability that at least one of a female couple will live to age 85; a 78% probability that one will live to age 90; a 52% probability to reach age 95; and a 24% probability (almost 1 in 4!) that at least one member of a female couple will live to age 100.

- Regardless of sex or marital affiliation, it’s clear that the odds of a person living an extended life span are significant enough to factor into retirement plans. But at what price?

While a retiree shouldn’t save all her money just because she may become a centenarian, the converse is also true. One shouldn’t overspend during early retirement because you’re banking on an early demise. Outliving your money is more than just a notion; it can be an unfortunate reality for many seniors.

In terms of how much is ‘safe’ to spend each year in retirement and what proportion of your assets should be set aside for longevity, there’s a middle ground for every client. They are conversations worth having, and we’re here to have them with you.