Key Questions for the Long Term Investor

December 31, 2019

As clients know, we use several mutual funds offered by Dimensional Fund Advisors (DFA) when we build investment portfolios. Their passively managed funds are based on extensive research, that claims to identify certain company-specific attributes that lead to better performance over extended periods.

This article1 by DFA, ‘Key Questions for the Long-Term Investor,’ seeks to answer a few questions to help investors understand what they can and can’t control. A few relevant excerpts along with some helpful charts:

1. Do I have to outsmart the market to be a successful investor?

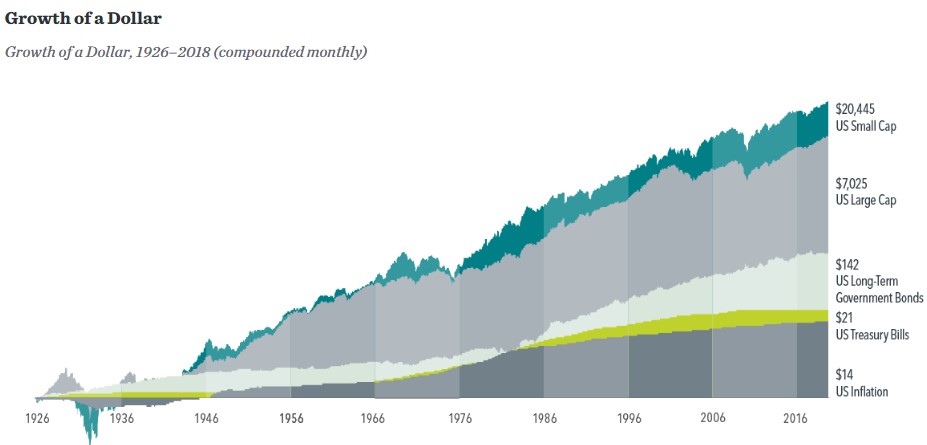

“Financial markets have rewarded long-term investors. People expect a positive return on the capital they invest, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation. Instead of fighting markets, let them work for you.”

2. Is there a better way to build a portfolio?

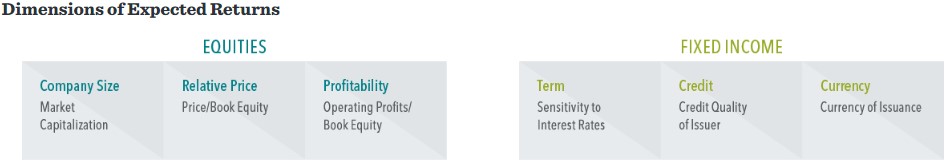

“Academic research has identified these equity and fixed income dimensions, which point to differences in expected returns among securities. Instead of attempting to outguess market prices, investors can instead pursue higher expected returns by structuring their portfolios around these dimensions.

3. Is international investing for me?

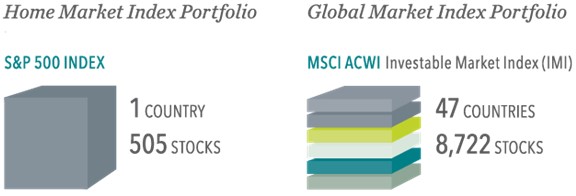

“Diversification helps reduce risks that have no expected return, but diversifying only within your home market may not be enough. Instead, global diversification can broaden your investment opportunity set. By holding a globally diversified portfolio, investors are well-positioned to seek returns wherever they occur.”

4. Will making frequent changes to my portfolio help me achieve investment success?

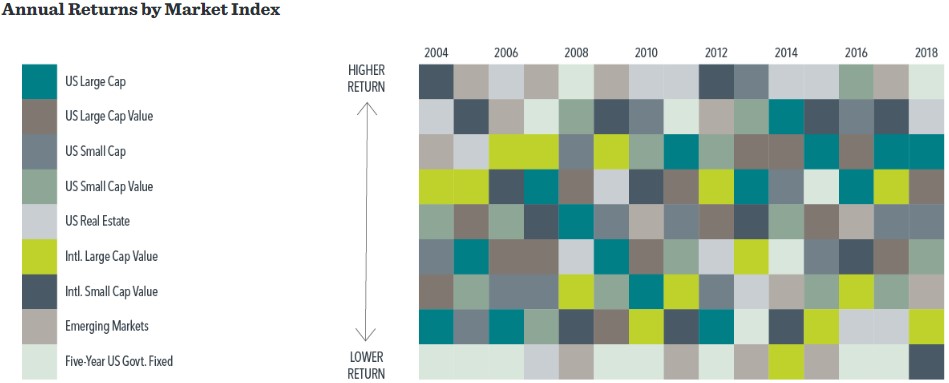

“It’s tough, if not impossible, to know which market segments will outperform from period to period. Accordingly, it’s better to avoid market timing calls and other unnecessary changes that can be costly. Allowing emotions or opinions about short-term market conditions to impact long-term investment decisions can lead to disappointing results.”

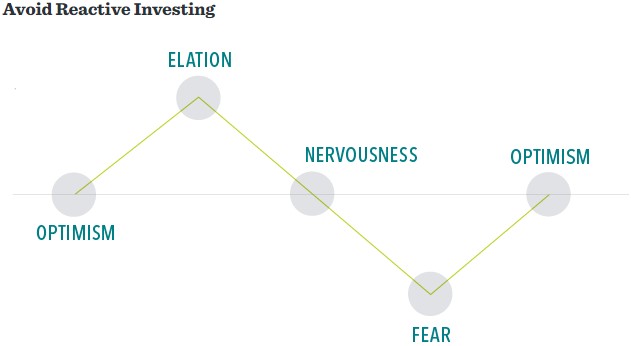

5. Can my emotions affect my investment decisions?

“Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions.”

6. Should I make changes to my portfolio based on what I’m hearing in the news?

“Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. If headlines are unsettling, consider the source and try to maintain a long-term perspective.”

All good advice for both novice and seasoned investors.