It's a wild, wild ride out there

August 15, 2019

During periods of volatility, or in anticipation of volatility, or just about any day of the week, it’s common to speak to a client or two about market volatility. The questions are often similar: “How can I get market returns with less risk?” Or, “Can’t we sell everything and go back in when things settle down?”

If the following questions aren’t asked, we’re sure clients wonder why they own fixed income (i.e., bond funds) when the stock market goes up; why they own equities when the stock market goes down; or why they own foreign equities when the S&P 500 seems to always go up.

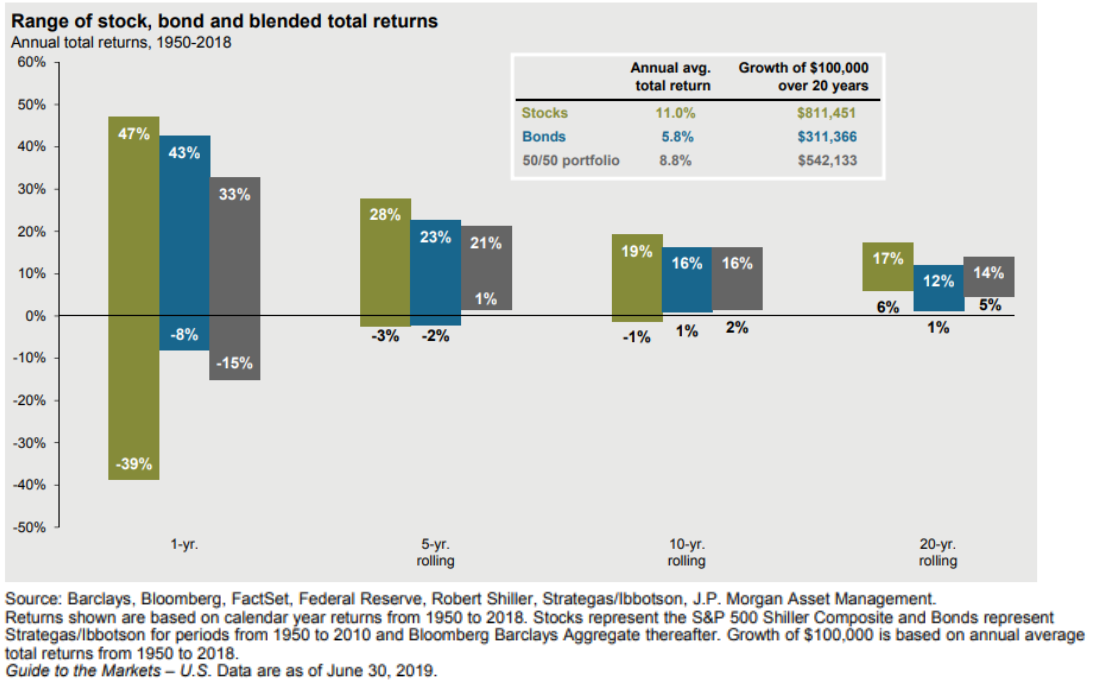

It’s probably not sufficient to answer these questions in the simplest fashion (You can’t; You can’t; Because you have to; Because you have to; Because you have to). To help answer these questions, the following chart from JP Morgan1 graphically depicts the performance of stock, bond, and blended portfolios over a variety of time frames (i.e., one year to rolling 20-year periods).

As the graph depicts, investors can’t get market returns unless they invest ALL of their assets into the market. And the market, as measured by the S&P 500, for example, is a potentially risky place to invest ALL of your money, unless you have a very long investment horizon.

In terms of getting out of the market when one anticipates a market downturn, we don’t have the ability to predict market peaks and valleys, so we ride through them and keep rebalancing. Trying to time the market (which relates to the three questions above that may often be thought but not asked) is typically a fool’s errand. Miss too many up days, and those gains are lost forever. And one of those great days may occur during a period when you’re out of the market because you thought it was going to fall.

In the end, the answer to how to reduce volatility and achieve returns that will make your retirement plan successful isn’t timing the market, but time in the market. Note how equity market volatility (as measured by annual average returns) drops from a range of -39% to +47% for any single year, to +6% to +17% over rolling 20-year periods.

As life expectancy continues to increase, the importance of a long game for investments takes on even more significance. That doesn’t mean you won’t have agita along the way, but odds are the ride will get less bumpy the further down the road you get.