If (the) Stock Market Feels Scary Right Now, That's Because It Is

June 30, 2020

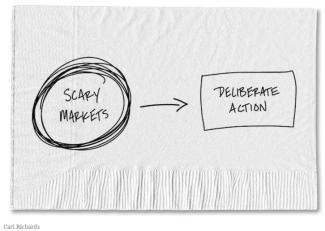

Writing in the Business Section of the New York Times1, that’s the title of a column by Carl Richards, who has gained fame as the “Sketch Guy”, a person who can take complex financial issues and define them through simple drawings. While the column includes a few of Richards’ sketches, it also includes five steps that investors might consider as we, along with the stock market, work through these perilous times.

- Give yourself a break: “The fact that you are feeling scared and uncertain is normal. It’s human. So the first step is to feel all the feels that come with scary news and scary markets. Just look at the news; how could you not be scared?” In other words: “Give yourself a break for feeling human.”

- Remember why you invested: Richards notes that it’s important to recall the purpose of a portfolio. For our clients, it’s to provide sufficient cash flow to continue the same lifestyle through retirement. To pay for those needs, some investment risk is involved, and that risk comes to us in the form of equities.

- Revisit the process: “Scary markets are quite literally part of the plan, since the stocks that give you decent returns over decades come with risk that their prices will bounce around a fair bit in the shorter term. As long as your goals remain the same, your carefully constructed investment plan still represents your best chance of achieving those goals.” If you think this time is different, a fairly common refrain, Richards notes some of the other scary times in the recent past: Y2K, West Nile virus, SARS, bird flu, global financial crisis, Swine flu, Ebola. We got through them all.

- Stay in the lifeboat: With a plan built on your goals, staying in the lifeboat simply means sticking with the market. We’re in the lifeboat together, and while this is not a drill, we all know what we have to do even as we’re being tossed around by the current storm.

- Do something else: if you feel as if you have to do something, Richards suggests you give yourself jobs to complete. If you’re concerned about the markets, redirect your energy. Richards’ personal list includes regular walks, making small increases to his savings account, getting outside, reading a new book, calling his mom, and checking on friends. They all represent something to do that you get to control.

While admittedly easier said than done, Richards concludes: “In the end, all we can do is control what we can and learn to accept what we can’t.”

1 “Richards, Carl. “If Stock Market Feels Scary Right Now That's Because It Is.” The New York Times, 27 June 2020, pp. B3.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by S.F. Ehrlich Associates, Inc. (“SFEA”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from SFEA. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SFEA is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of SFEA’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a SFEA client, please remember to contact SFEA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, or revising our previous recommendations and/or services.