How bad can it get before it gets better?

May 15, 2020

By: John Zeltmann

In the midst of a market downturn like we've seen over the past couple of months, and with the daily bombardment of bad economic news, it's easy to think the downtrend will continue. Looking at one's retirement plan over several months rather than several years, it's easy to feel despair, especially during times like these. When will the U.S. re-open? When will kids go back to school? When will grocery stores be safe? What about a vaccine? What will normal look like and when will it get here?

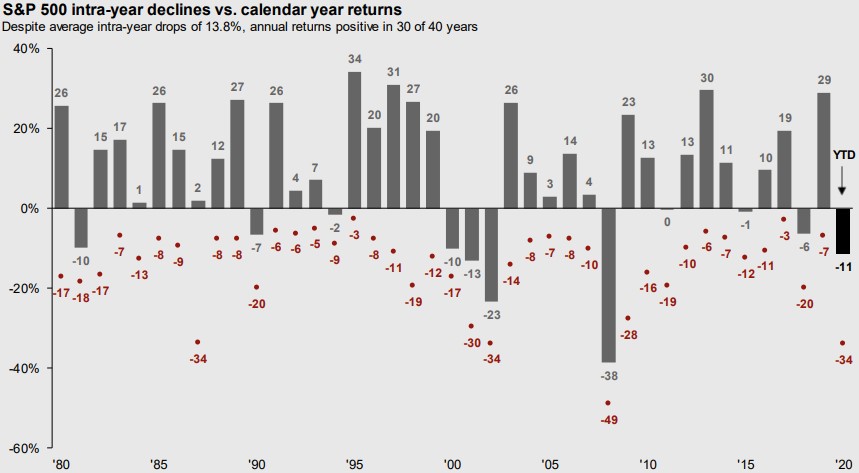

While we can't control when the new normal will arrive, we can control how we handle our portfolios, and the chart below helps to explain that we shouldn’t let the extreme emotions of the moment impact how we plan for the long-term.

The table reflects annual calendar year returns for the U.S. large company stocks (represented by the S&P 500 index, dark gray bars) dating back to 1980. Despite average intra-year declines of 13.8% (each year's max downturn is shown by a red dot) annual returns have been positive in 30 of 40 calendar years.

Over the past 40 years, we have experienced our share of traumatic market events: 1987's Black Monday, the tech bubble followed by September 11th in the early 2000s, the Global Financial Crisis in 2008, and the current COVID pandemic. In the midst of each of these crises, a light at the end of the tunnel was barely visible, if at all. What is clear from the chart above, though, is that the market is capable of recovering from intra-year drops and, in many cases, even finishing in positive territory. Will we finish 2020 in the black? The S.F. Ehrlich Associates brain trust isn't smart enough to know, though we are confident that brighter days will return at some point down the road. While each crisis brings its own unique challenges, bad actors, threats, and potential doors to doomsday, it can also be a breeding ground for innovation, development, and opportunity - we are a capitalist society after all. Imagine the developments and innovations that will come out of industries such as healthcare, technology, energy, hotels, restaurants, and many others.

As long as there's a daily flow of news media, there will always be a reason to get out of the market. Keys to a successful retirement include less time spent on responding to market moves and more time focusing on the things you can do over the long-run to ensure retirement success (e.g., filling your schedule with fulfilling activities, managing cash flow in retirement, saving during your working years, a properly drafted estate plan, smart tax planning).

Lastly: your retirement plans are built for times like this. Each of the financial plans we run for clients assumes investment experiences like we've seen during the crises mentioned above; just because the markets seem broken, remember that your financial plan and the investment strategy we're implementing to achieve your goals is not.