Should cryptocurrency be in your portfolio?

Occasionally, we receive questions from clients about cryptocurrency. Clients either want to own some or ask if it should be included in their portfolio. We’re very consistent in our response, so we’ll share our thinking on the subject.

What is cryptocurrency? We can easily explain things like large cap stocks, emerging market stocks, and short-term bonds—traditional investments that many people are familiar with. But when it comes to alternative investments, like cryptocurrencies, the picture gets a little less clear. Put simply, a cryptocurrency—like Bitcoin or Ethereum - is a type of digital money. It isn’t issued by any government or controlled by a bank. Instead, it runs on a kind of shared online system (called a blockchain) that keeps track of every transaction in a secure and transparent way. This technology has made it possible for people to send money, invest, and even build new types of financial tools—all without needing a traditional middleman.

Who backs cryptocurrencies? No one single person, company, or government "backs" most cryptocurrencies. Their value comes from what people are willing to pay for them, much like gold or art. Some newer digital currencies are tied to real-world assets (like the U.S. dollar), but most—including Bitcoin—are based on trust and demand in the market.

Who mints, or produces cryptocurrencies? Most cryptocurrencies are created by computer networks. For example, new Bitcoins are produced through a process called mining, where computers solve complex puzzles to earn coins as a reward. Other cryptocurrencies might be issued all at once or over time by the developers who created them. Mining cryptocurrency is an expensive and technically challenging process.

How can you use a cryptocurrency? In order to use a cryptocurrency, you would create an online, or digital wallet. This online wallet stores your encryption keys that confirm your identity along with the cryptocurrency you hold. You could then either trade your cryptocurrency on a crypto exchange or use it to purchase a good or service by transferring some of your cryptocurrency to a company that accepts it. Alternatively, you could also sell your cryptocurrency and convert it to cash.

Should you buy cryptocurrency as an investment? We recommend that most investors do not purchase cryptocurrency as an investment. Not only are cryptocurrency prices often highly volatile, but your ability to profit depends entirely on someone else being willing to pay more than you did. When you buy stock in a company, you're investing in that company’s future—if it grows and earns more money, your investment becomes more valuable. When you buy a bond, you’re lending money in exchange for regular interest payments. Cryptocurrencies offer neither of these benefits. Their prices are largely driven by hype, speculation, and market sentiment rather than underlying financial performance. One of the key selling points of cryptocurrency is security—transactions are designed to be protected and difficult to tamper with. But in practice, the technology is still evolving, and the space has not yet earned widespread regulatory oversight or consumer protection. If the security of any individual cryptocurrency is compromised—whether through hacking, coding flaws, or operational failures—it could quickly erase substantial value, both in that currency and across the broader crypto market. Until the ecosystem matures and is more thoroughly vetted, we believe a cautious approach is best.

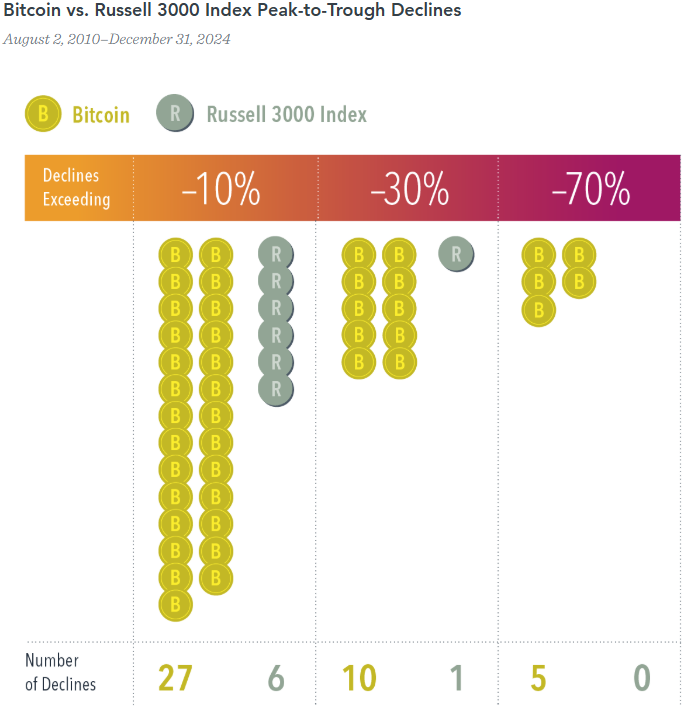

Per Dimensional1, “Over the past decade, Bitcoin’s annualized volatility has been nearly five times higher than that of the Russell 3000 Index—76.9% compared to 15.8%.1 Since its first recorded market price in August 2010, Bitcoin has taken investors on a volatile ride, with 27 peak-to-trough declines exceeding 10%, 10 declines exceeding 30%, and five declines exceeding 70%.”

While sentiment towards cryptocurrencies is currently high, who knows whether that sentiment will continue going forward? Should sentiment change, how much financial destruction will be left in its wake?

1 “Higgins, Kristi. “Bitcoin: A Crumby Way to Save for Later.” Dimensional, 10 June 2025.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by S.F. Ehrlich Associates, Inc. (“SFEA”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from SFEA. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SFEA is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of SFEA’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a SFEA client, please remember to contact SFEA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, or revising our previous recommendations and/or services.