Stan's World - What a year it's been...and it's only May!

Admittedly, this has been a tumultuous year for investors. And when I say investors, I’m referring to anyone who invests hard-earned money into the stock market. Or the bond market. Or any other market you can name.

But if we’re going to be honest with each other, what year hasn’t felt like a tumultuous year to be an investor? When was the last time you announced on January 1st: “I am not going to look at my stock market portfolio until one year from today?” That’s not normal investor behavior.

If you’ve been in this business long enough, you hear it all, or think it all:

“I wish I owned more stocks.”

“I wish I owned more bonds.”

“I wish I owned only US stocks.”

“I wish I didn’t own any US stocks.”

And let’s not forget the years where one might ponder, perhaps only half-jokingly: “Why don’t I just keep all my money under my mattress?” (As an aside, should you ever consider that mattress thing, make sure the premium for your homeowner’s insurance policy is current. And include a rider on your policy that says something like: “Cover me for stacks of cash in case of a house fire.”)

When it comes to investing, who doesn’t want to own winners and jettison the losers? Me included. But every time I think I’ve got it, every time I think there’s a glimmer of hope that I’m smarter than everyone else, I get a reminder that I’m wrong.

From my experience, those people who think they’re smarter than everyone else are more inclined to place bets. (It’s not called investing when you think you know who the winners will be. That’s called betting.) And when we place bets, one of two things is likely to happen: we win (big), or we lose (big).

In the simplest of terms, the more risk we take, the greater the potential return. But there’s also an inverse logic to that; the greater the risk, the greater the potential for significant loss. If you had invested all your money in Microsoft over the years, you would have done pretty well. But if you had placed those same dollars in a former blue-chip stock named Enron, the outcome would have been exactly the opposite.

We really do understand client trepidation when watching the wild swings the stock market brings. While it may sound ironic, some volatility is necessary to achieve long-term results. Not only is volatility built into portfolios, it’s also built into financial plans. We know markets will occasionally go crazy; we just don’t know when.

As you watch the markets ebb and flow, may I suggest you watch them less, or even not at all. It’s not worth the aggravation. If you must watch, and you have any concerns about your money, just call. Yes, if your portfolio is down, it can be disheartening. (Remember: down is still down.) But if you’re retired and need ongoing income, it’s built into your portfolio. If you have dozens of years before retirement and short-term swings will have no impact on your long-term goals, your portfolio is built for that. And so on, and so forth.

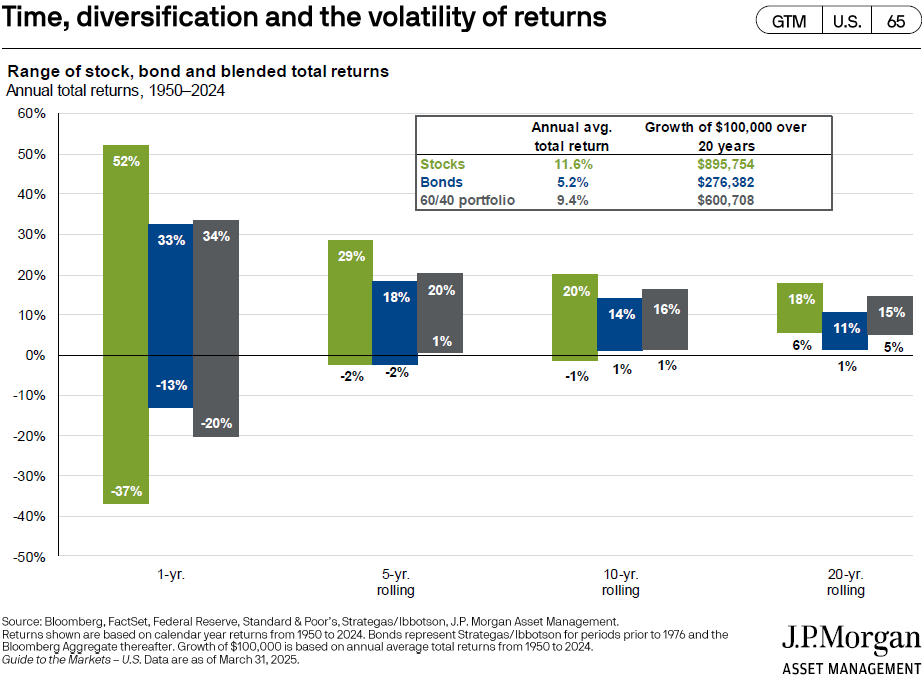

We periodically include a chart in our newsletter or attach it to quarterly memos that graphically depicts annual volatility, and we’ve included it below1. As you can see, the potential for volatility in any given year is substantial. In any single calendar year, the S&P 500 has provided returns that ranged from -37% to +52%. But extend the range of years and watch how returns begin to moderate. Over any five calendar years, for example, the range of the S&P 500 on an annualized basis ranges from -2% to +29%. Over ten years: -1% to +20%. And so on.

I’ve often described our investing style as like watching grass grow. Sexy? No. Boring? Absolutely. In fact, if I didn’t have a fear of heights, I’d stand on the highest rooftop and shout: “Diversify! Rebalance!”

But if you’re really into betting, and we’re still doing the whole honesty thing with each other, let me share what I believe would be the safest bet you could ever make. Should I ever wind up on a rooftop, in any city, at any time, you can bet my first screams will not include the words “diversify” or “rebalance.” That’s my definition of a safe bet.

1 “Time, diversification, and the volatility of returns,” Slide 65, Guide to Retirement, J.P. Morgan. March 31, 2025.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by S.F. Ehrlich Associates, Inc. (“SFEA”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from SFEA. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SFEA is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of SFEA’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a SFEA client, please remember to contact SFEA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating, or revising our previous recommendations and/or services.