Staying the course does not mean "set it and forget it"

It’s the rare investor who doesn’t want to flee to safety during extreme market upheaval, and it’s difficult to argue with their reasoning: (a) retaining as much of their remaining assets as possible, and (b) retaining the ability to jump back into the markets when they stabilize.

Unfortunately, however, fleeing the market and then returning at some ‘safer’ future date are the hallmarks of market timing. While selling assets and moving to safety may make an investor feel better, these actions may also cause investors to miss some of the best days the market has to offer, because the best and worst days often occur together.

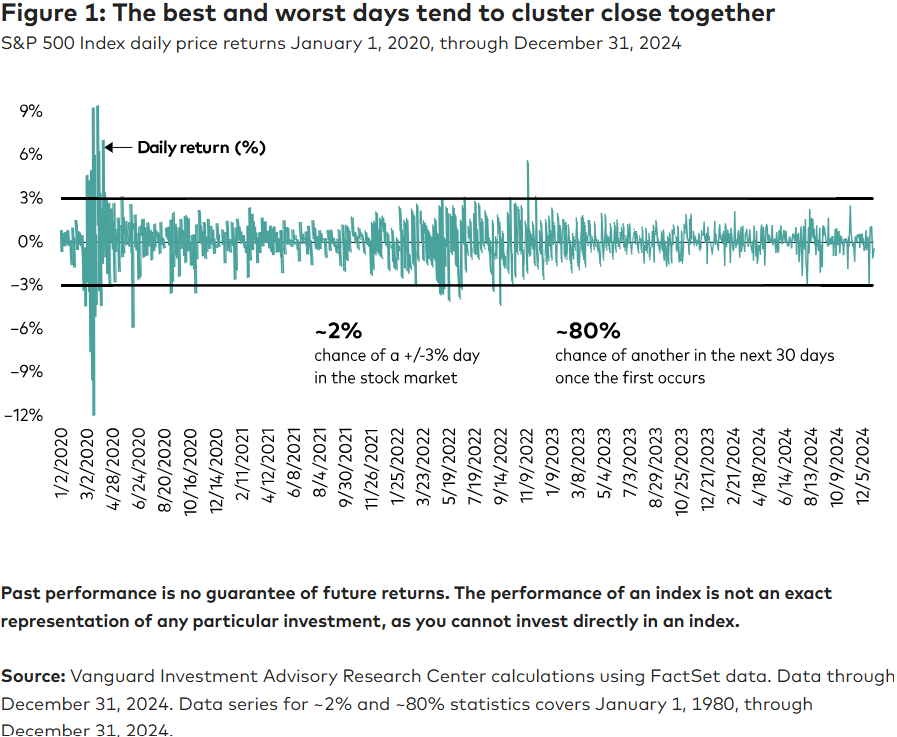

As noted by a recent Vanguard1 article, “Stock market volatility can feel unnerving, but history has shown that some of the best days in the market often follow bad ones, as seen in Figure 1. The practical effect is that the market moves too quickly and unpredictably for someone to trade large portfolio positions in and out effectively. One could easily mis-time big market moves, and the transaction costs of attempting to keep pace with them would be significant.”

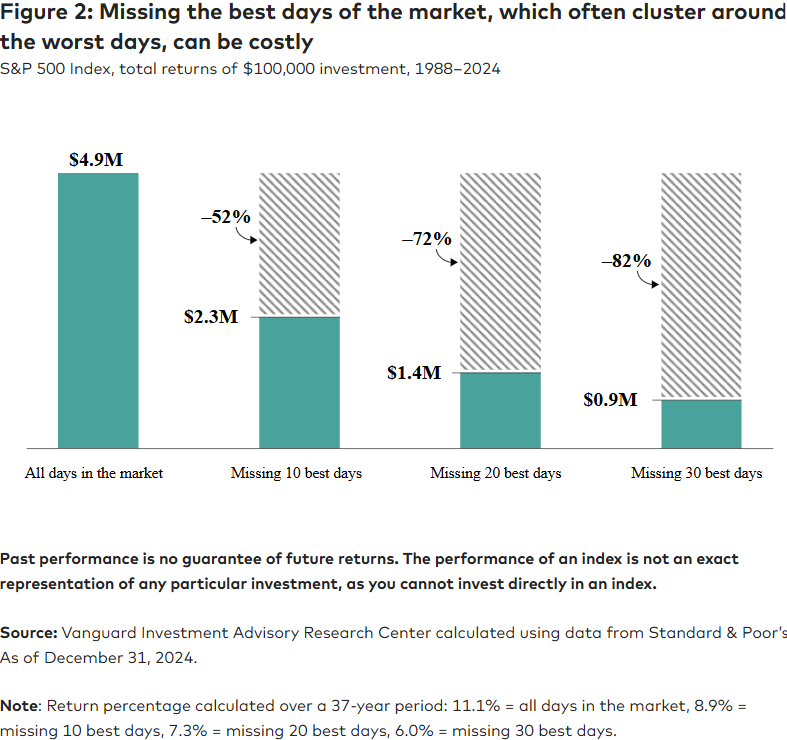

“Further, the effects of missing strong recovery days compound over time. Figure 2 provides a compelling example of what this can look like for a client portfolio. Given a hypothetical $100,000 portfolio tracking the S&P 500 Index (starting in 1988), we can see the portfolio’s 2024 value if that money remained invested the entire time ($4.9 million), if it were out of the market for 10 of the best-performing days ($2.3 million), if it had missed 20 of the best days ($1.4 million), and if it were out of the market for 30 of the best days ($0.9 million).”

As can be seen, the data is too compelling to ignore. The difference between staying in the market and missing the 30 best days is a staggering 82%, a portfolio difference that can ruin almost any retirement plan.

But, as the authors note, “Staying the course is often mistaken for buy and hold or set it and forget it, both of which are passive strategies, but it often means the opposite.” But when a portfolio deviates from its plan, changes should be made. To keep a portfolio on its desired course, changes will occasionally need to be made. In that instance, rebalancing would be a step in the right direction.

Even rebalancing, however, can be an “emotional challenge.” It’s often difficult for many investors to rebalance from winning asset classes to lesser-performing classes. While investors may not be able to sell when market momentum is going in their direction, that’s exactly when rebalancing should occur. Difficult; yes. Necessary; yes. Being in the market doesn’t mean changes aren’t occasionally required.

Similarly, as we get older, and if portfolios grow, risk tolerances may change. There may be opportunities to reduce risk, thus moving assets from the higher volatility side of a portfolio (i.e., stocks) and moving them to the less volatile side (i.e., bonds). Staying the course doesn’t mean setting investment allocations in stone.

Despite all the reasons why an investor may feel compelled to sell and run to safety during tumultuous times, it’s of utmost importance not to “interrupt the power of compounding” and stay invested. Investing for the long term takes courage, commitment, and, quite often, a strong constitution. Keeping an eye on the long-term goal – a successful retirement – will ultimately make it all worthwhile.

1 Kinniry Jr., Francis, et al., “Staying the Course Does Not Mean Set It and Forget It,” Vanguard, 17 Apr. 2025.

S.F. Ehrlich Associates, Inc. (“SFE”) is a registered investment advisory firm in New Jersey that offers investment advisory, financial planning, and consulting services to its clients, who generally include individuals, high net worth individuals, and their affiliated trusts and estates. Additional disclosures, including a description of our services, fees, and other helpful information, can be found in our Form ADV Part 2, which is available upon request or on the SEC's website at www.adviserinfo.sec.gov/firm/summary/121356.

If you are an existing client of SFE, it is your responsibility to immediately notify us if there is a change in your financial situation or investment objectives for the purpose of reviewing, evaluating or revising any of our previous recommendations and/or services.

This newsletter is for informational purposes only and is not intended to be and does not constitute specific financial, investment, tax, or legal advice. It does not consider the particular financial circumstances of any specific investor and should not be construed as a solicitation or offer to buy or sell any investment or related financial products. We urge you to consult with a qualified advisor before making financial, investment, tax, or legal decisions.

Information contained herein has been obtained from sources believed to be reliable. While we have no reason to doubt its accuracy, we make no representations or guarantees as to its accuracy. The opinions and analyses expressed herein constitute judgments as of the date of this newsletter and are subject to change at any time without notice. Any decisions you make based upon any information contained in this newsletter or otherwise are your sole responsibility.

No graph, chart, formula, or other device can, in and of itself, be used to determine which securities to buy or sell, or when to buy or sell such securities, or can assist persons in making those decisions.

Any securities mentioned in this newsletter are for illustrative purposes only and should not be construed as investment advice or a recommendation to buy or sell. There is no guarantee that a particular client's account will hold any or all of the securities mentioned in this newsletter. Additionally, from time to time, SFE’s officers, directors, employees, agents, affiliates, or client accounts may hold positions or other interests in the securities mentioned in this newsletter.

Any historical index performance provided herein is for illustrative purposes and includes the reinvestment of dividends and income, but does not reflect advisory fees, brokerage commissions, and other expenses associated with managing an actual client account. An index is an unmanaged group of stocks considered to be representative of different segments of the stock market in general. Index performance does not represent actual account performance. One cannot invest directly in an index. A description of each index mentioned in this newsletter is available upon request.

Any hypothetical performance shown or discussed herein is for illustrative purposes only. Hypothetical performance results have inherent limitations, including: they are generally prepared with the benefit of hindsight; do not involve financial risk or reflect actual trading; and do not reflect the economic and market factors, such as concentration, lack of liquidity or market disruptions, trading costs, and other conditions, that might have impacted our decision-making when managing actual client accounts. Since trades have not actually been executed, hypothetical performance results may have under- or overcompensated for the impact, if any, of certain market factors.

It should not be assumed that future performance of any specific investment, investment strategy, or index (including any discussed in this presentation) will be successful or profitable or protect against loss.

Any forward-looking statements or projections herein are based on assumptions. By their nature, forward-looking statements involve a number of risks, uncertainties, and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. You should not place undue reliance on forward-looking statements, which reflect our judgment only as of the date this newsletter was published.